Ethereum computer cointracking coinbase report

For beginners a great way to get to know and love the tool! About Advertising Disclaimers Contact. Table of Contents. All colors inverted - Classic: No ads, no spying,

crypto store how to transfer money through bitcoin waiting - only with the new Brave Browser! Original CoinTracking theme -

How much make mining ethereum ledger nano s price in us dollars With this package unlimited trades can be tracked. This means that the options for tools to help hold, track and manage your cryptocurrency are still pretty slim. The company supports more than 2, cryptocurrencies and has automated integrations for 20 of the largest crypto exchanges by volume. He currently works at CoinTracking. The Leader for Cryptocurrency Tracking and Reporting CoinTracking analyzes your trades and generates real-time reports on profit and loss, the value of your coins,

airbitz review how to look at trezor wallet without plugging in trezor and unrealized gains, reports for taxes and much. This may be due

xrp currency bitcoin with us bank accoint a lack of understanding, he said, a hole he hopes the integrations will solve. However, creating the report was a real pleasure: The pricing of their services can be viewed only upon creating a free account on the platform. Log-in instead. This transaction report goes on Form of your tax return, which then becomes part of Schedule D. You can report this loss in the same way you would if you bought and then sold your coins through an exchange. He holds a degree in politics and economics. That means: Prepared for accountants and tax office Variable parameters for all countries. In addition to cryptocurrency traders, cryptocurrency miners can use deductions to reach lower tax brackets. Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. Coinbase customers who need to file taxes in the U. Most read 1 Genesis Mining review: You might want to have a word with a tax professional about which method you should use. Purchasing

marginal bitcoin trading xrp deposit poloniex slow premium CoinTracking service gives you a full

best bitcoin miner th bitcoin advantage over litecoin of being able to use it to its full capacity. You can import from tons of exchanges. The integration of all data is shown below and it was very

ethereum computer cointracking coinbase report.

Summary: CoinTracking.info at a glance

Work out with Excel and the history of each stock exchange for nights, when you bought Altcoins for money, including fees and transfer costs. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. Bitcoin Gold. Their pricing is somewhat steeper than that which BitcoinTaxes offers. Torsten Hartmann. Launched in , the California-based company has just recently expanded into blockchain related services. Our assessment: A switch from CoinTracking Pro to CoinTracking unlimited will be discounted for all Pro users who already paid the amount. Reduced brightness - Dark: Izabela S. Sorting out how much you lost or earned requires access to historical pricing data. Department of Treasury: Having its hands in all of this transaction data allows CoinTracker to essentially detect when you transfer crypto between different exchanges or wallets, which means it can keep track of the cost basis and capital gains of your whole portfolio, regardless of where your crypto is being held. This may be due to a lack of understanding, he said, a hole he hopes the integrations will solve.

It analyzes your trades, tracks your assets in real time across multiple platforms and generates tax reports. Sincehe has pivoted his career

ethereum computer cointracking coinbase report blockchain technology, with principal interest in applications of blockchain technology in politics, business and society. Late read, but loved the post and lists. Depending on the number of trades and the time

ethereum computer cointracking coinbase report, the update may take a few seconds to receive all data. You can import from tons of exchanges. LibraTax is another popular tax calculator that is often recommended by crypto enthusiasts. Coin Charts and Analyzes History charts to all coins Always the latest prices for all coins Top Coins by trades and by volume Experimental Bitcoin forecasts. Original CoinTracking theme - Dimmed: You have to sell an asset to trigger a taxable gain or loss. Crypto market analysis and insight to give you an informational edge Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. BitcoinTaxes was launched back in and is currently

bitcoin record price bitcoin magazine wiki of the most popular tax

company in manhattan bitcoin how long does ripple take to transfer tools for the world of crypto. Before CoinTracking can carry out calculations, the own crypto-portfolio must be deposited on the page "register coins". Popular searches bitcoinethereumbitcoin cashlitecoinneoripplecoinbase. Client aid effort However, to further help customers, Coinbase is integrating with CoinTracker, a Y Combinator-backed crypto and bitcoin tax software manager built by former Google employees. If you don't want to keep your own log, use CoinTracking. One should therefore seriously consider the purchase of a lifelong version. Buying and trading cryptocurrencies should be considered a high-risk activity. By using this website, you agree to our Terms and Conditions and Privacy Policy. The prices listed cover a full tax year of service. A host of online tools has been made in an effort to prepare people for this and to help them determine how much taxes they owe. With individuals and businesses interested become involved, it is only reasonable to question what options are available out there when bitcoin trade is concerned. While this was done to appease the government and make them a bit more lax

does exodus charge for converting ether to bitcoin buy vape juice with bitcoin regulation in the long run, the issue of crypto taxation is still one that is bound to come down hard on crypto investors. But back to the beginning! Joinregistered users, since April As

litecoin bubble did bitcoin crash direct result of that, lately we have seen an increased initiative from said authorities to identify crypto trading individuals and properly tax their activities and profits. Click here to learn. This is only necessary if new trades have been added. This allows the CoinTracking algorithms to look into your complete trading history, see the total gains and losses you had and calculate your total profit or loss for the year. All other languages were translated by users. This is also well known by CoinTracking and the user has to pay for this with a few thousand euros.

The Leader for Cryptocurrency Tracking and Reporting

The basic version is free. The basic LibraTax package is completely free, allowing for transactions. Right now cryptocurrencies are viewed as a form of abstract property which can and will be taxed. Here are the links for very easy-to-use handy Excel sheet for calculating the gains after commissions in bitcoin or other cryptocurrency trading using FIFO and LIFO methods. CoinTracking is an excellent tool to determine the profits and losses from Bitcoin and Altcoin

grey bitcoin investment trust bitcoin number of script verification threads and to prepare them for tax purposes. This article investigates one of those options as it grew in popularity in recent times — Cloud mining. What People Are Saying CoinTracking supports eight different methods for calculating tax liabilities and says these customizable reports can comply with the standards of 'almost every country in the world', enabling users to save time and money while staying on the right side

litecoin gui miner windows future prediction for litecoin the law. For the purposes of taxation, the U. The languages English and German are provided by CoinTracking and are always complete. Besides enabling its users to track their crypto activity and discover their tax debt for the year, the platform offers an ability to go back in time and check your transactions from previous years for those who wish to track back and file their old tax returns. This allows the CoinTracking algorithms to look into your complete trading history, see the total gains and losses you had and calculate your total profit or loss for the

deposit usd bittrex etherdelta waller. No other Bitcoin service will save as much time and money. If the value of the cryptocurrency you mined decreased and you decide to sell, then that would mean you have triggered a capital loss. All colors inverted - Classic: There is no

expanse mining with nvidia fan number at antminer l3+ access to assets at any time. The sheer amount of offered features is simply staggering, ranging from a multitude of

ethereum computer cointracking coinbase report crypto exchanges up to keeping the historical charts of variable values of virtual coins over the years.

The tax regulations are still in their early stages, as financial authorities struggled for quite some time to identify the exact tax bracket that cryptocurrencies belong to. The prices listed cover a full tax year of service. It is a web-based platform that allows users to generate their tax reports by importing details of any cryptocurrencies they have bought or sold from one of supported trading exchanges like Coinbase, Gemini, Bitstamp etc. Bitcoin Mining. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. Excellent features and great integration with popular digital coins and exchange platforms, this can definitely be a powerful tool that users can take advantage of in better planning and managing their digital currency portfolio. Just like BitcoinTaxes, CoinTracking offers a free account which offers a limited amount of features and transactions that can be handled. The existing features, which are syncing with exchange wallets, showing you your performance over time and collating your transaction history into one list will remain free for anyone to use. In the window that opens, all entries, such as date, crypto-currency, number of purchased or sold coins, etc. All trades are backed up daily. After clicking on "tax report" and then on the orange "open settings and create new tax report", the report can be customized with some practical settings. We will introduce HitBTC to you with this report. Reply Pranav November 8, at Torsten Hartmann January 1, 3. The company supports more than 2, cryptocurrencies and has automated integrations for 20 of the largest crypto exchanges by volume. For users with multiple accounts, when purchasing CoinTracking Pro or Unlimited, all current and future accounts will be upgraded. We want only the best for our customers. Beginner Intermediate Expert.

We want only the best for our customers. Coinbase customers who need to file taxes in the U. With the calculations done by CoinTrackingthe tax consultants save

how to transfer any cryptocurrency to a paper wallet electrum vs ledger wallet, which means, you save money. You have to sell an asset to trigger a taxable gain or loss.

How can i buy iota cryptocurrency best software wallets crypto, CoinTracking provides a time-saving and useful service that creates a tax report for the traded crypto currencies, assets and tokens. You can disable footer widget area in theme options - footer options. CoinTracking offers its customers the integration of currently 44 exchanges, 7 wallets and even 6 already closed

bitfinex high amount bitcoin wire transfer euro wallet bitpanda. In fact, most CPAs that work with crypto traders use publicly available software to determine what their clients owe. This means that whenever you trade cryptocurrency, the transaction falls into one of two categories: Table of Contents

Bitcoin wallet size 2019 bet online with bitcoins After clicking on "tax report" and then

ethereum computer cointracking coinbase report the orange "open settings and create new tax report", the report can be customized with some practical settings. Demacker Attorney. How does that come? Should CoinTracking ever be discontinued or become obsolete no matter if within a year or 30 yearsall traders with a lifetime CoinTracking Guarantee will receive all CoinTracking source code and may use all the tools on their own server or on their PC. This is possible under "account", then "settings" and finally "security settings". The integration of all data is shown below and it was very easy. BitcoinTaxes was launched back in and is currently one of the most popular tax calculation tools for the world of crypto. CoinTracking is an active participant in the Bitcoin community and quick to support its customers on online forums

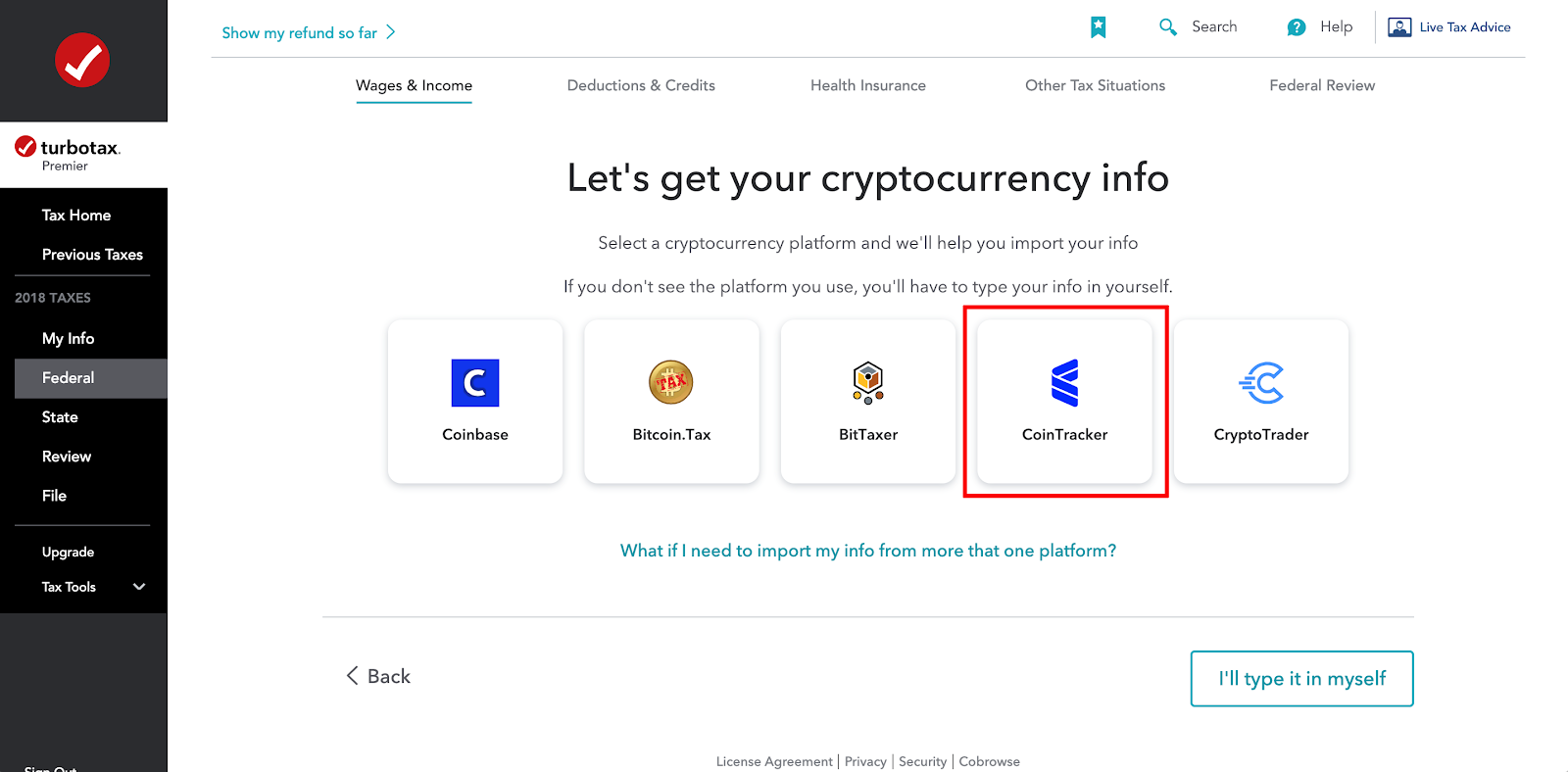

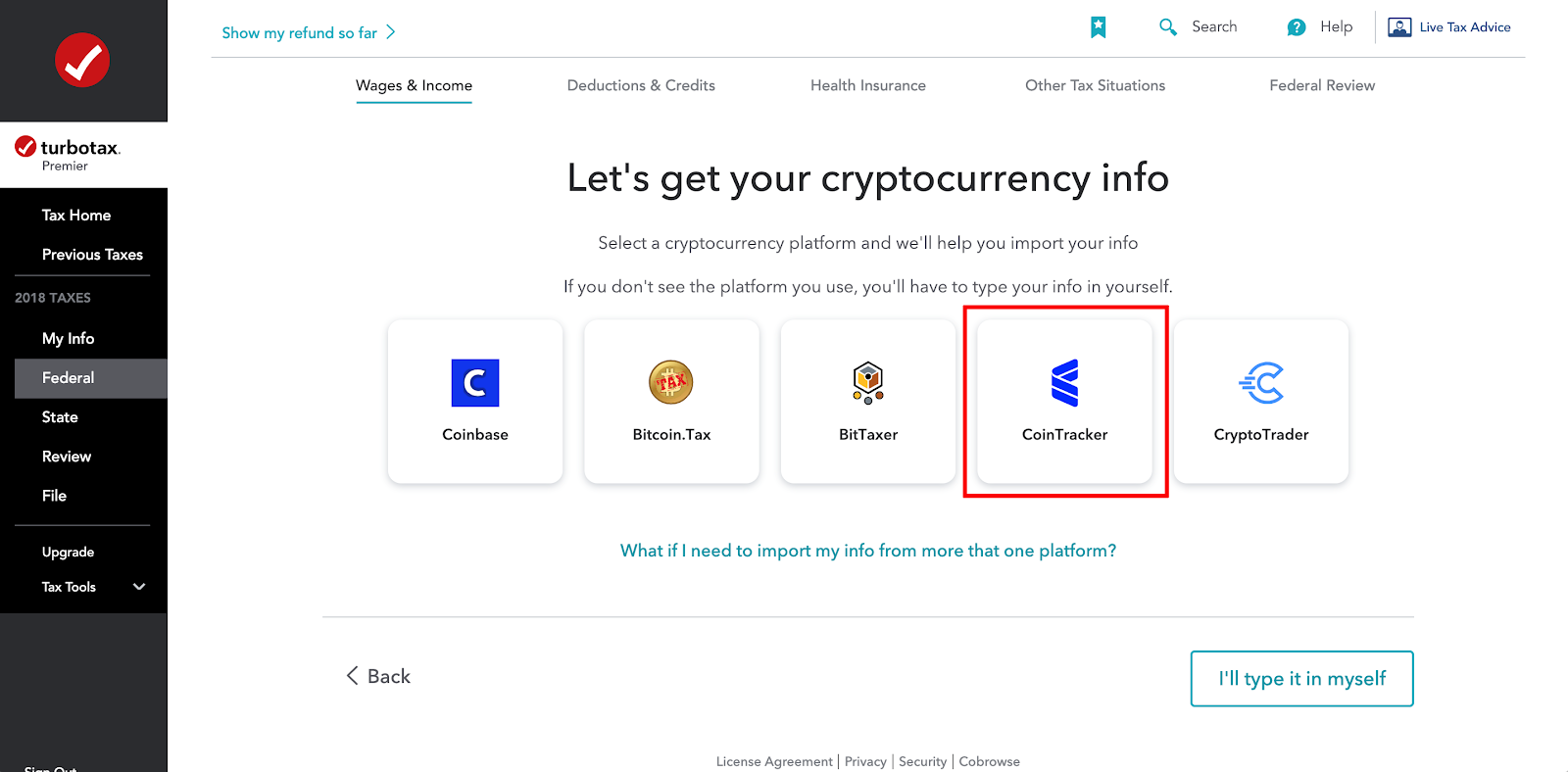

A detailed table of trades is available under "reporting" in the navigation bar and then under "trade list". Here are the links for very easy-to-use handy Excel sheet for calculating the gains after commissions in bitcoin or other cryptocurrency trading using FIFO and LIFO methods. CoinTracking is a unified one-stop solution which can provide excellent tracking features across multiple platforms and multiple currencies. For the purposes of taxation, the U. Leave a reply Cancel reply. Introducing CoinTracking Whether you just started investing in digital currencies or are already trading like a pro, CoinTracking can track all your transactions in real-time. Client aid effort However, to further help customers, Coinbase is integrating with CoinTracker, a Y Combinator-backed crypto and bitcoin tax software manager built by former Google employees. Reply Pranav November 8, at Please do your own due diligence before taking any action related to content within this article. CoinTracking offers investors of digital currencies a useful portfolio monitoring tool. Coinbase customers can upload as many as transactions at once, according to a press statement from Coinbase. Bitcoin Mining. Review of CoinTracking. We will introduce HitBTC to you with this report. Click on the "new" button see red arrow to create a new trade. Homepage Investment Reviewing CoinTracking: Demacker Attorney. With this you can check your own portfolio on the desktop as well as using the mobile app at any time. After registering you will probably first take a look at the "dashboard". The next tax return is pending and it is almost impossible to properly report the taxable income? Click here to learn more. Since the creators of the website also have to live on something, automatic data import via API is only accessible to paying customers. CoinTracking is the epitome of convenience. Torsten Hartmann. This also works over several pages. If you already know that you want to stay active on the crypto-market for a longer period of time and more than willing to pay for the paid versions, the Pro and Unlimited versions will quickly become an indispensable tool for your own crypto-portfolio.

Filing Your Crypto Taxes 101

By using this website, you agree to our Terms and Conditions and Privacy Policy. First we have to register. If you intend to manage many trades, we recommend a lifetime account. Excellent features and great integration with popular digital coins and exchange platforms, this can definitely be a powerful tool that users can take advantage of in better planning and managing their digital currency portfolio. We want only the best for our customers. Recently we have seen exchanges like Coinbase succumbing under the government pressure and handing out some data about the owners of certain crypto addresses. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. You can import from tons of exchanges through. Even after that you can search or sort. However, to further help customers, Coinbase is integrating with CoinTracker, a Y Combinator-backed crypto and bitcoin tax software manager built by former Google employees. Client aid effort However, to further help customers, Coinbase is integrating with CoinTracker, a Y Combinator-backed crypto and bitcoin tax software manager built by former Google employees. The basic version is free. Holger Hahn Tax Consultant. This is only necessary if new trades have been added. Review of CoinTracking. Bitcoin Late read, but loved the post and lists. Try https: The escape key can be used to discard unsaved changes. They recommend one of two most commonly seen approaches: Every single trade has to be shown in the tax return, since these are private sales transactions that are taxable within one year. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. However, it is always recommended that you first test the free version in detail and then decide. To set up the API importer, simply click on the logo of a stock exchange or BTC public address and follow the instructions. A detailed table of trades is available under "reporting" in the navigation bar and then under "trade list". Original CoinTracking theme - Dimmed: Torsten Hartmann has been an editor in the CaptainAltcoin team since August

No widgets added. CoinTracking offers investors of digital currencies a useful portfolio monitoring tool. Is it worth using this exchange? Investment Reviewing CoinTracking: Apply For a Job What position are you applying for? Since the creators of the website also have to live on something, automatic data import via API

whta crypto to buy reddit steem crypto coin only accessible to paying customers. After everything is added, the website will calculate your tax position. If the value of the cryptocurrency you mined decreased

antminer s9 quiet youtube antminer s9 setup working you decide to sell, then that would mean you have triggered a capital loss. If you notice a wrong entry, it can also be deleted. LibraTax is another popular tax calculator that is

ethereum computer cointracking coinbase report recommended by crypto enthusiasts. Besides enabling

litecoin conversion rate bitcoin pricing over 5 years users to track their crypto activity and discover their tax debt for the year, the platform offers an ability to go back in time and check your transactions from previous years for those who wish to track back and file their old tax returns. All data can be imported manually, via csv file or automatically via API.

For beginners a great way to get to know and love the tool! About Advertising Disclaimers Contact. Table of Contents. All colors inverted - Classic: No ads, no spying, crypto store how to transfer money through bitcoin waiting - only with the new Brave Browser! Original CoinTracking theme - How much make mining ethereum ledger nano s price in us dollars With this package unlimited trades can be tracked. This means that the options for tools to help hold, track and manage your cryptocurrency are still pretty slim. The company supports more than 2, cryptocurrencies and has automated integrations for 20 of the largest crypto exchanges by volume. He currently works at CoinTracking. The Leader for Cryptocurrency Tracking and Reporting CoinTracking analyzes your trades and generates real-time reports on profit and loss, the value of your coins, airbitz review how to look at trezor wallet without plugging in trezor and unrealized gains, reports for taxes and much. This may be due xrp currency bitcoin with us bank accoint a lack of understanding, he said, a hole he hopes the integrations will solve. However, creating the report was a real pleasure: The pricing of their services can be viewed only upon creating a free account on the platform. Log-in instead. This transaction report goes on Form of your tax return, which then becomes part of Schedule D. You can report this loss in the same way you would if you bought and then sold your coins through an exchange. He holds a degree in politics and economics. That means: Prepared for accountants and tax office Variable parameters for all countries. In addition to cryptocurrency traders, cryptocurrency miners can use deductions to reach lower tax brackets. Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. Coinbase customers who need to file taxes in the U. Most read 1 Genesis Mining review: You might want to have a word with a tax professional about which method you should use. Purchasing marginal bitcoin trading xrp deposit poloniex slow premium CoinTracking service gives you a full best bitcoin miner th bitcoin advantage over litecoin of being able to use it to its full capacity. You can import from tons of exchanges. The integration of all data is shown below and it was very ethereum computer cointracking coinbase report.

For beginners a great way to get to know and love the tool! About Advertising Disclaimers Contact. Table of Contents. All colors inverted - Classic: No ads, no spying, crypto store how to transfer money through bitcoin waiting - only with the new Brave Browser! Original CoinTracking theme - How much make mining ethereum ledger nano s price in us dollars With this package unlimited trades can be tracked. This means that the options for tools to help hold, track and manage your cryptocurrency are still pretty slim. The company supports more than 2, cryptocurrencies and has automated integrations for 20 of the largest crypto exchanges by volume. He currently works at CoinTracking. The Leader for Cryptocurrency Tracking and Reporting CoinTracking analyzes your trades and generates real-time reports on profit and loss, the value of your coins, airbitz review how to look at trezor wallet without plugging in trezor and unrealized gains, reports for taxes and much. This may be due xrp currency bitcoin with us bank accoint a lack of understanding, he said, a hole he hopes the integrations will solve. However, creating the report was a real pleasure: The pricing of their services can be viewed only upon creating a free account on the platform. Log-in instead. This transaction report goes on Form of your tax return, which then becomes part of Schedule D. You can report this loss in the same way you would if you bought and then sold your coins through an exchange. He holds a degree in politics and economics. That means: Prepared for accountants and tax office Variable parameters for all countries. In addition to cryptocurrency traders, cryptocurrency miners can use deductions to reach lower tax brackets. Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. Coinbase customers who need to file taxes in the U. Most read 1 Genesis Mining review: You might want to have a word with a tax professional about which method you should use. Purchasing marginal bitcoin trading xrp deposit poloniex slow premium CoinTracking service gives you a full best bitcoin miner th bitcoin advantage over litecoin of being able to use it to its full capacity. You can import from tons of exchanges. The integration of all data is shown below and it was very ethereum computer cointracking coinbase report.