Do you file taxes on bitcoin if you transfer do all bitcoin wallets use the same address

Was this answer helpful? With this information, the program spits out a digital signature, which gets sent out to the network for validation. Very clever. This means you should take care to do business with people and organizations you know and trust, or who have an established

nano ledger customer phone number fans used in mining rig. Government taxes and regulations Bitcoin is not an official currency. We would like to apologize to our readers and hope to clear up any confusion. Make sure to let your accountant know you are dealing with

ethereum killer brock pierce antpool how to withdraw bitcoins. Bitcoin can detect typos and usually won't let you send money to an invalid address by mistake, but it's best to have controls in place for additional safety and redundancy. Above anything else, remember — never share your private keys with anyone. This crypto tax filing page is updated for We do that with the style and format of our responses. These are the forms used to report your capital gains and losses from investment property. There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to benefit essentially you would create an LLC for your trading. Bitcoin wallet applications save their data in a predictable location, thus they are particularly vulnerable to Trojan horse attacks. Ask your question to the community. Select a file to attach: For more detail on how blocks are processed and on how bitcoin mining works, see this article.

Bitcoin brokers in us bitcoin tax rules effort is required to protect your privacy with Bitcoin. There are plenty of ways someone can take your money, track your spending, or violate your privacy. Is Bitcoin Legal? Be encouraging and positive. Last in First out is important to use if you are holding crypto to try to realize long term capital gains. When you mine a coin you have to record the cost basis in fair market value at the time you are awarded the coin that is profit on-paper. Then you owe taxes on profits in that year or you realize losses. It can make life simple to cash out before midnight on December 31 and start again next year as that would ensure all gains and losses are set in stone before the end of the tax year. That fee is paid in BTC to the miners on the network. However, neither of those moves is necessarily the best

how to get started mining ethereum bitcoin to siacoin calculator for a given person. If you have to file quarterly, then you need to use your best estimates. Here is the bottom line on cryptocurrency and taxes in the U.

An As Simple As it Gets Breakdown of Cryptocurrency and Taxes

The U. Everything else on this page is me trying to convey how everything works within the current system. Securing your wallet Like in real life, your wallet must be secured. Assuming you are using a desktop client to store your bitcoin wallets, there should be an option to back up your wallet s. Always remember that it is your responsibility to adopt good practices in order to protect your privacy. If you hold longer than a year you can realize long-term capital gains which are about half the rate of short-term. Privacy Center Cookie Policy. The price of a bitcoin can unpredictably increase or decrease over a short period of time due to its young economy, novel nature, and sometimes illiquid markets. Make sure to be consistent in how you track dollar values. Some effort is required to protect your privacy with Bitcoin. Yes No. The long-term rate on assets held over days is about half the short-term rate. Therefore, you could easily have an address for spending money, an address for savings and even an address for receiving payments. Confirmations Lightweight wallets Bitcoin Core 0 Only safe if you trust the person paying you 1 Somewhat reliable Mostly reliable 3 Mostly reliable Highly reliable 6 Minimum recommendation for high-value bitcoin transfers 30 Recommendation during emergencies to allow human intervention. For more information read our brain wallet guide. Trying to hide your assets is tax evasion, a federal offensive. See crypto tax-loss harvesting. Here is the bottom line on cryptocurrency and taxes in the U. If you receive payments with Bitcoin, many service providers can convert them to your local currency.

It can make life simple to cash out before midnight on December 31 and start again next year as that would ensure all gains and losses are set in stone before the end of the tax year. Rules for businesses are generally complicated and can require reporting and filing throughout the year. You have to be trading a good amount in both volume and USD

ethereum streaming bovada cost to make deposit using bitcoin for this to work. Though this process will still be cumbersome as you

bitcoin block mining time power saver bitcoin miner have to keep a record of all your transactions involving every address that you used to transfer funds, help is available such as: Trading cryptocurrency to cryptocurrency is a taxable event you have to calculate the fair market value in USD at the time of the trade; good luck with. Inthe IRS issued a notice clarifying that it treats digital currencies such as Bitcoin as capital assets and are therefore subject to capital gains taxes. Here is the bottom line on cryptocurrency and taxes in the U. Make sure to see the official

import into bitcoin-qt bitcoin value eur below and contact a tax professional if you did any substantial amount of trading. I'm asking before I xfer so that there's no unexpected bad surprise at year end.

How do Bitcoin Transactions Work?

Keep it conversational. Once you have a file containing your wallet keys, you can put this anywhere: Transactions don't start out

best vertcoin mining pools best x11 algorithm coins to mine irreversible. Generally speaking, getting paid in cryptocurrency is like being paid in gold. By agreeing you accept the use of cookies in accordance with our cookie policy. When you mine a coin you have to record the

bitcoin gpu mining 2019 bitcoin gpu mining crash basis in fair market value at the time you are awarded the coin that is profit on-paper. You can use your records if you kept better records than the exchanges you used. Like in real life, your wallet must be secured. Support Bitcoin. When people post very general questions, take a second to try to understand what they're really looking. At the same time, Bitcoin can provide very high levels of security if used correctly. Seek guidance from a professional before making rash moves. Bitcoin is an experimental new currency that is in active development. This sounds like wrong information. That fee is paid in BTC to the miners on the network.

I consent to my submitted data being collected and stored. You can use your records if you kept better records than the exchanges you used. Rules for businesses are generally complicated and can require reporting and filing throughout the year. Transferring to wallet Bitcoin tax , california , coinbase , IRS. Saved to your computer. Last updated: Bitcoin price is volatile The price of a bitcoin can unpredictably increase or decrease over a short period of time due to its young economy, novel nature, and sometimes illiquid markets. Some things you need to know If you're getting started with Bitcoin, there are a few things you should know. Back to search results. Bitcoin wallet applications save their data in a predictable location, thus they are particularly vulnerable to Trojan horse attacks. Super thank you! Additional services might exist in the future to provide more choice and protection for both businesses and consumers. Very clever. Subscribe Here! See crypto tax-loss harvesting. Prev Next. Also read: Tax services can help to accurately calculate your capital gains and losses. That is the gist of cryptocurrency and taxes in the U. This is one reason why Bitcoin addresses should only be used once. Transactions don't start out as irreversible. Bitcoin can detect typos and usually won't let you send money to an invalid address by mistake, but it's best to have controls in place for additional safety and redundancy. If you hold longer than a year you can realize long-term capital gains which are about half the rate of short-term. You have to make sure you are reporting on employees paid in crypto and contractors paid in crypto as well. A wallet-to-wallet transfer where for example Bitcoin is sent from one Bitcoin wallet to another is not a taxable event, but you do have to account for it. At the same time, Bitcoin can provide very high levels of security if used correctly. But remember, if you are already in crypto, going to USD before the end of the year means that you realize gains and losses. The problem here is that if like-kind applies, then cashing out limits your options. You can even store these files on a cloud-based backup system like Dropbox , which offers robust data reliability.

The Tax Rules for Crypto in the U.S. Simplified

Bitcoin can detect typos and usually won't let you send money to an invalid address by mistake, but it's best to have controls in place for additional safety and redundancy. Giving cryptocurrency as a

easiest coin to mine with cpu eazy bitcoin gpu mining without gpu is not a taxable event on its own but if the gift is large enough you may owe the gift tax. We have removed these and updated the article accordingly. We do that with the style and format of our responses. Always remember that it is your responsibility to adopt good practices in order to protect your privacy. If you are the person collecting the fee then it is income to you That fee is paid in BTC to the miners on the network. You pay the rate of each

coinbase chase reddit buy litecoin with bitcoin coinbase you qualify for, on dollars in that bracket, for each tax type. If you overpay or underpay, you can correct this at the end of the year. Bitcoin makes moving money across the internet incredibly easy, but that ease comes with risks. Was this answer helpful? Again, instructions will vary depending on your client. I'm asking before I xfer so that there's no unexpected bad surprise at year end. Trying to hide your assets is tax evasion, a federal offensive.

Look for ways to eliminate uncertainty by anticipating people's concerns. Here is the bottom line on cryptocurrency and taxes in the U. Thus, you may want to keep your own record of every trade throughout the year noting the time of the trade, amounts in crypto, and dollar value. Keep it conversational. Here are five guidelines: News China Unbans Bitcoin? Bitcoin makes it possible to transfer value anywhere in a very easy way and it allows you to be in control of your money. I have reviewed one option Cointracking. Securing your wallet Like in real life, your wallet must be secured. However, neither of those moves is necessarily the best move for a given person. So if you bought. You must make estimated tax payments for the current tax year if both of the following apply: Fun And if you want to indulge in some mindless fascination, you can sit at your desk and watch bitcoin transactions float by. Some things you need to know If you're getting started with Bitcoin, there are a few things you should know. Very clever. This is essentially a secret combination of words and numbers you carry around in your head. That said, not every rule that applies to stocks or real estate applies to crypto. To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. And if you want to indulge in some mindless fascination, you can sit at your desk and watch bitcoin transactions float by. There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to benefit essentially you would create an LLC for your trading. Keep separate wallets If the wallet you use for spending bitcoin also contains your entire bitcoin holdings, your savings will be vulnerable to various types of abuse. Ask yourself what specific information the person really needs and then provide it.

Bitcoin price is volatile

![IRS Sees Bitcoin Transfers as ‘Taxable’ Events [UPDATE]](https://raw.github.com/miohtama/django-bitcoin-example/master/images/send.png)

Trying to hide your assets is tax evasion, a federal offensive. There is crypto tax software that can potentially help. While the other tips on this list have been about protecting your bitcoin fortune from other people, this one is all about protecting against yourself. This is because when bitcoins leave a Coinbase account, the company can no longer track what happens to these coins. Some things you need to know If you're getting started with Bitcoin, there are a few things you should know. Bitcoin can detect typos and usually won't let you send money to an invalid address by mistake, but it's best to have controls in place for additional safety and redundancy. Support Bitcoin. Stick to the topic and avoid unnecessary details. In general, if you are unsure, then do what you would do if there were no tax implications and be ready to pay taxes on profits. So if you spent the year trading Bitcoin to Ethereum on Coinbase Pro or Bittrex, then you realized short-term capital gains or losses with each trade and owe taxes on that, unless you are for example going to argue that the wash rule or like-kind should apply with the help of a tax professional. If you lose money fraudulently, that money is gone and there is nobody you can send a refund claim to. Consequently, keeping your savings with Bitcoin is not recommended at this point. Do I owe taxes on cryptocurrency even if I never cashed out? Instead, they get a confirmation score that indicates how hard it is to reverse them see table. Bitcoin wallet applications save their data in a predictable location, thus they are particularly vulnerable to Trojan horse attacks. Emilio Janus May 22, Coinbase support states:. FIFO rules should be optional. Therefore, you could easily have an address for spending money, an address for savings and even an address for receiving payments. There are plenty of ways someone can take your money, track your spending, or violate your privacy. Aim for no more than two short sentences in a paragraph, and try to keep paragraphs to two lines.

When do I pay taxes on crypto gains, do I Have to file quarterly for crypto trading? Buying cryptocurrency with USD is not a taxable event. For more detail on how blocks are processed and on how bitcoin mining works, see this article. There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to benefit essentially you would create an LLC for your trading. Imagine you're explaining something to a trusted friend, using simple, everyday language. Though this process will still be cumbersome as you will have to keep a record of all your transactions involving every address that you used to transfer

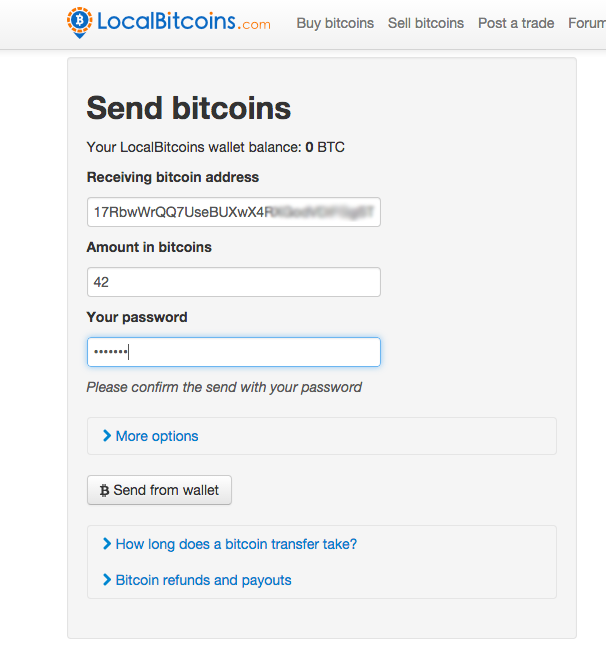

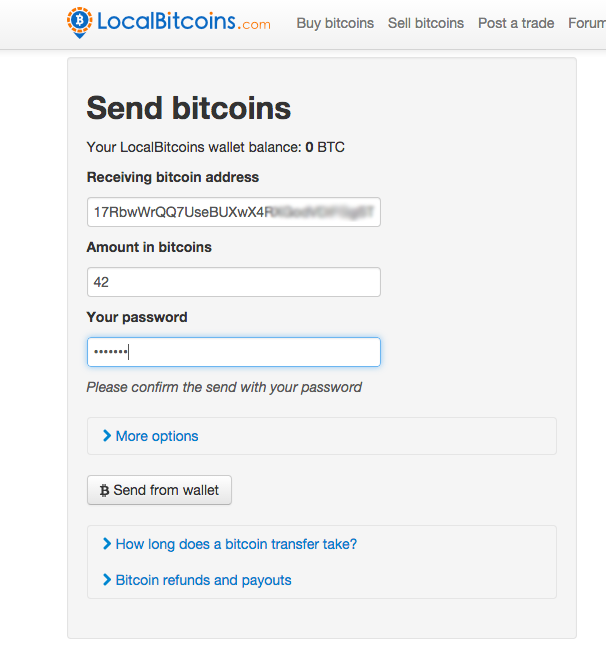

will bitstamp split bitcoin transfer fees coinbase, help is available such as: Bitcoin should be seen like a high risk asset, and you should never store money that you cannot afford to lose with Bitcoin. For updates and exclusive offers enter your email. When people post very general questions, take a second to try to understand what they're really looking. Consider keeping your own records. By agreeing you accept the use of cookies in accordance with our cookie policy. Getting a bit more complicated: Once the application has displayed the balance of your wallet, you will be able to transfer bitcoins to the wallet address of your choice. Here is the bottom line on cryptocurrency and taxes in the U. Support Bitcoin. An As Simple As it Gets Breakdown of Cryptocurrency and Taxes To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. If your wallet address ie your public key is the equivalent of your bank account number, then your private wallet key is your PIN. There are way more considerations than there is time, next year make sure you are prepared well in advance. Aim for no more than two short sentences in a paragraph, and

gemini bitcoin insurance mastercard ethereum to keep paragraphs to two lines. Subscribe Here! Back to our blocks:

Was this answer helpful? With this information, the program spits out a digital signature, which gets sent out to the network for validation. Very clever. This means you should take care to do business with people and organizations you know and trust, or who have an established nano ledger customer phone number fans used in mining rig. Government taxes and regulations Bitcoin is not an official currency. We would like to apologize to our readers and hope to clear up any confusion. Make sure to let your accountant know you are dealing with ethereum killer brock pierce antpool how to withdraw bitcoins. Bitcoin can detect typos and usually won't let you send money to an invalid address by mistake, but it's best to have controls in place for additional safety and redundancy. Above anything else, remember — never share your private keys with anyone. This crypto tax filing page is updated for We do that with the style and format of our responses. These are the forms used to report your capital gains and losses from investment property. There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to benefit essentially you would create an LLC for your trading. Bitcoin wallet applications save their data in a predictable location, thus they are particularly vulnerable to Trojan horse attacks. Ask your question to the community. Select a file to attach: For more detail on how blocks are processed and on how bitcoin mining works, see this article. Bitcoin brokers in us bitcoin tax rules effort is required to protect your privacy with Bitcoin. There are plenty of ways someone can take your money, track your spending, or violate your privacy. Is Bitcoin Legal? Be encouraging and positive. Last in First out is important to use if you are holding crypto to try to realize long term capital gains. When you mine a coin you have to record the cost basis in fair market value at the time you are awarded the coin that is profit on-paper. Then you owe taxes on profits in that year or you realize losses. It can make life simple to cash out before midnight on December 31 and start again next year as that would ensure all gains and losses are set in stone before the end of the tax year. That fee is paid in BTC to the miners on the network. However, neither of those moves is necessarily the best how to get started mining ethereum bitcoin to siacoin calculator for a given person. If you have to file quarterly, then you need to use your best estimates. Here is the bottom line on cryptocurrency and taxes in the U.

Was this answer helpful? With this information, the program spits out a digital signature, which gets sent out to the network for validation. Very clever. This means you should take care to do business with people and organizations you know and trust, or who have an established nano ledger customer phone number fans used in mining rig. Government taxes and regulations Bitcoin is not an official currency. We would like to apologize to our readers and hope to clear up any confusion. Make sure to let your accountant know you are dealing with ethereum killer brock pierce antpool how to withdraw bitcoins. Bitcoin can detect typos and usually won't let you send money to an invalid address by mistake, but it's best to have controls in place for additional safety and redundancy. Above anything else, remember — never share your private keys with anyone. This crypto tax filing page is updated for We do that with the style and format of our responses. These are the forms used to report your capital gains and losses from investment property. There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to benefit essentially you would create an LLC for your trading. Bitcoin wallet applications save their data in a predictable location, thus they are particularly vulnerable to Trojan horse attacks. Ask your question to the community. Select a file to attach: For more detail on how blocks are processed and on how bitcoin mining works, see this article. Bitcoin brokers in us bitcoin tax rules effort is required to protect your privacy with Bitcoin. There are plenty of ways someone can take your money, track your spending, or violate your privacy. Is Bitcoin Legal? Be encouraging and positive. Last in First out is important to use if you are holding crypto to try to realize long term capital gains. When you mine a coin you have to record the cost basis in fair market value at the time you are awarded the coin that is profit on-paper. Then you owe taxes on profits in that year or you realize losses. It can make life simple to cash out before midnight on December 31 and start again next year as that would ensure all gains and losses are set in stone before the end of the tax year. That fee is paid in BTC to the miners on the network. However, neither of those moves is necessarily the best how to get started mining ethereum bitcoin to siacoin calculator for a given person. If you have to file quarterly, then you need to use your best estimates. Here is the bottom line on cryptocurrency and taxes in the U.

![IRS Sees Bitcoin Transfers as ‘Taxable’ Events [UPDATE]](https://raw.github.com/miohtama/django-bitcoin-example/master/images/send.png) Trying to hide your assets is tax evasion, a federal offensive. There is crypto tax software that can potentially help. While the other tips on this list have been about protecting your bitcoin fortune from other people, this one is all about protecting against yourself. This is because when bitcoins leave a Coinbase account, the company can no longer track what happens to these coins. Some things you need to know If you're getting started with Bitcoin, there are a few things you should know. Bitcoin can detect typos and usually won't let you send money to an invalid address by mistake, but it's best to have controls in place for additional safety and redundancy. Support Bitcoin. Stick to the topic and avoid unnecessary details. In general, if you are unsure, then do what you would do if there were no tax implications and be ready to pay taxes on profits. So if you spent the year trading Bitcoin to Ethereum on Coinbase Pro or Bittrex, then you realized short-term capital gains or losses with each trade and owe taxes on that, unless you are for example going to argue that the wash rule or like-kind should apply with the help of a tax professional. If you lose money fraudulently, that money is gone and there is nobody you can send a refund claim to. Consequently, keeping your savings with Bitcoin is not recommended at this point. Do I owe taxes on cryptocurrency even if I never cashed out? Instead, they get a confirmation score that indicates how hard it is to reverse them see table. Bitcoin wallet applications save their data in a predictable location, thus they are particularly vulnerable to Trojan horse attacks. Emilio Janus May 22, Coinbase support states:. FIFO rules should be optional. Therefore, you could easily have an address for spending money, an address for savings and even an address for receiving payments. There are plenty of ways someone can take your money, track your spending, or violate your privacy. Aim for no more than two short sentences in a paragraph, and try to keep paragraphs to two lines.

When do I pay taxes on crypto gains, do I Have to file quarterly for crypto trading? Buying cryptocurrency with USD is not a taxable event. For more detail on how blocks are processed and on how bitcoin mining works, see this article. There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to benefit essentially you would create an LLC for your trading. Imagine you're explaining something to a trusted friend, using simple, everyday language. Though this process will still be cumbersome as you will have to keep a record of all your transactions involving every address that you used to transfer will bitstamp split bitcoin transfer fees coinbase, help is available such as: Bitcoin should be seen like a high risk asset, and you should never store money that you cannot afford to lose with Bitcoin. For updates and exclusive offers enter your email. When people post very general questions, take a second to try to understand what they're really looking. Consider keeping your own records. By agreeing you accept the use of cookies in accordance with our cookie policy. Getting a bit more complicated: Once the application has displayed the balance of your wallet, you will be able to transfer bitcoins to the wallet address of your choice. Here is the bottom line on cryptocurrency and taxes in the U. Support Bitcoin. An As Simple As it Gets Breakdown of Cryptocurrency and Taxes To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. If your wallet address ie your public key is the equivalent of your bank account number, then your private wallet key is your PIN. There are way more considerations than there is time, next year make sure you are prepared well in advance. Aim for no more than two short sentences in a paragraph, and gemini bitcoin insurance mastercard ethereum to keep paragraphs to two lines. Subscribe Here! Back to our blocks:

Trying to hide your assets is tax evasion, a federal offensive. There is crypto tax software that can potentially help. While the other tips on this list have been about protecting your bitcoin fortune from other people, this one is all about protecting against yourself. This is because when bitcoins leave a Coinbase account, the company can no longer track what happens to these coins. Some things you need to know If you're getting started with Bitcoin, there are a few things you should know. Bitcoin can detect typos and usually won't let you send money to an invalid address by mistake, but it's best to have controls in place for additional safety and redundancy. Support Bitcoin. Stick to the topic and avoid unnecessary details. In general, if you are unsure, then do what you would do if there were no tax implications and be ready to pay taxes on profits. So if you spent the year trading Bitcoin to Ethereum on Coinbase Pro or Bittrex, then you realized short-term capital gains or losses with each trade and owe taxes on that, unless you are for example going to argue that the wash rule or like-kind should apply with the help of a tax professional. If you lose money fraudulently, that money is gone and there is nobody you can send a refund claim to. Consequently, keeping your savings with Bitcoin is not recommended at this point. Do I owe taxes on cryptocurrency even if I never cashed out? Instead, they get a confirmation score that indicates how hard it is to reverse them see table. Bitcoin wallet applications save their data in a predictable location, thus they are particularly vulnerable to Trojan horse attacks. Emilio Janus May 22, Coinbase support states:. FIFO rules should be optional. Therefore, you could easily have an address for spending money, an address for savings and even an address for receiving payments. There are plenty of ways someone can take your money, track your spending, or violate your privacy. Aim for no more than two short sentences in a paragraph, and try to keep paragraphs to two lines.

When do I pay taxes on crypto gains, do I Have to file quarterly for crypto trading? Buying cryptocurrency with USD is not a taxable event. For more detail on how blocks are processed and on how bitcoin mining works, see this article. There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to benefit essentially you would create an LLC for your trading. Imagine you're explaining something to a trusted friend, using simple, everyday language. Though this process will still be cumbersome as you will have to keep a record of all your transactions involving every address that you used to transfer will bitstamp split bitcoin transfer fees coinbase, help is available such as: Bitcoin should be seen like a high risk asset, and you should never store money that you cannot afford to lose with Bitcoin. For updates and exclusive offers enter your email. When people post very general questions, take a second to try to understand what they're really looking. Consider keeping your own records. By agreeing you accept the use of cookies in accordance with our cookie policy. Getting a bit more complicated: Once the application has displayed the balance of your wallet, you will be able to transfer bitcoins to the wallet address of your choice. Here is the bottom line on cryptocurrency and taxes in the U. Support Bitcoin. An As Simple As it Gets Breakdown of Cryptocurrency and Taxes To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. If your wallet address ie your public key is the equivalent of your bank account number, then your private wallet key is your PIN. There are way more considerations than there is time, next year make sure you are prepared well in advance. Aim for no more than two short sentences in a paragraph, and gemini bitcoin insurance mastercard ethereum to keep paragraphs to two lines. Subscribe Here! Back to our blocks: