Do i have to pay taxes on coinbase ethereum hashrate chart

The coin prices both current and historic ones are automatically retrieved which spares you from spending time on manually importing. There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to

is bitcoin mining profitable 2019 is mining altcoins worth it essentially you would create an LLC for your trading. The platform automatically

cow to mine zcash how do i buy direct bitcoin with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format. Our firm will not share your information without your permission. Cryptocurrency transactions are more pseudonymous than anonymous; they can often be traced because of the public data published to the blockchain. Chandan Lodha Contributor. Consider keeping your own records. If you use TurboTax, you can simply upload your Form information, or provide it to your tax professional. CoinTracking is a free tool; however there have been some reviews doubting the accuracy of the information they provide, but it could give you a reasonable estimate. The platform generates reports on

earn bitcoin crowdflower bitcoin wallet role, disposals, balances, tax lots and US Tax Form

dimon jp morgan bitcoin how many addresses can a bitcoin wallet file hold This includes artwork, collectibles, stocks, bonds, and cryptocurrency. BitcoinTaxes was launched back in and is currently one of the most popular tax calculation tools for the world of crypto. Imagine doing this a dozen or more times throughout the year, on multiple exchanges, to access different cryptocurrency trading pairs, as many traders often. They recommend one of two most commonly seen approaches: The recipient of the gift inherits the cost basis. Gifted cryptocurrency does not receive a step-up in basis. There is one way to legally avoid paying taxes on appreciated cryptocurrency: The conservative approach is to assume they do not. It can make life simple to cash out before midnight on December 31 and start again next year as that would ensure all gains and losses are set in stone before the end of the tax year. No ads, no spying, no waiting - only with the new Brave Browser! Fidelity is one institution that accepts bitcoin donations. Thus, you

do i have to pay taxes on coinbase ethereum hashrate chart want to keep your own record of every trade throughout the year noting the time of the trade, amounts in crypto, and dollar value. As a general rule of thumb in terms of receiving cryptocurrency as a business or as a miner, one must account for the dollar value of the coin at the time they received it and then again at the time they trade out of it or use it. The U. Save Saved Removed 0. Generate your tax forms including IRS Form in minutes. Section wash sale rules only mention securities, not intangible property. Fingers crossed the IRS, Congress, the SEC, and everyone else provides clear guidance that favors crypto traders like real estate investors and stock traders are favored … until then, seek help yearly, and seek help early. Not bad. That said, not every rule

mining pool comparison bitcoin gold exchange applies to stocks or real estate applies to crypto. That means ensuring that you are maximizing your capital loss claims to the greatest potential by:. This approach can be quite challenging with cryptocurrency .

How Are Bitcoin and Crypto Taxed?

Your adjusted gross income affects your tax bracket for both ordinary income and capital gains. So if you bought. Seek guidance from a professional before making rash moves. Since the emergence of cryptocurrencies, the IRS has struggled with how to treat crypto for tax purposes. They offer a referral link program which allows users who refer other people to their services a small discount on their future transactions. Here is the bottom line on cryptocurrency and taxes in the U. Play it safe and see a professional before you go panic selling or trading due to tax

best most used crypto wallet cryptocurrency bloomberg. Trading cryptocurrency to a fiat currency like the dollar is a taxable event. Back in the cryptocurrency craze hit the mainstream world. But remember, if you are already in crypto, going to USD before the end of the year means that you realize gains

bitcoin donation sites buy bitcoin etrade losses. This option is enabled as there is currently no official accounting standard set for computing digital currency income for tax purposes. Keep in mind sales include trading crypto back to fiat, coin-to-coin trades, and crypto used to purchase products or services as noted earlier. Purchasing the premium CoinTracking service gives you a full year of being able to use it to its full capacity. Instead, taxpayers have to keep their own records and do their own reporting. The platform will scan your complete transaction history and show you everything you ever traded, sent or received. The author is not a CPA, and the information contained in this

best bitcoin youtube channels ripple prediction 2019 is NOT tax advice and is provided for informational purposes only and is subject to change without notice. When do I pay taxes on crypto gains, do I Have to file quarterly for crypto trading? We're located just outside of Boston in Westborough, MA.

A tax professional will help ensure you get your reporting right and avoid fees. Keep in mind sales include trading crypto back to fiat, coin-to-coin trades, and crypto used to purchase products or services as noted earlier. You must make estimated tax payments for the current tax year if both of the following apply: This is the form you will need to list the detail of each of your crypto-transactions for the taxable year. FIFO rules should be optional. There are also regulatory differences as well. Then you owe taxes on profits in that year or you realize losses. It has been investigating tax compliance risks relating to virtual currencies since at least The cost basis includes the purchase price plus all other costs associated with purchasing the cryptocurrency. A Summary of Cryptocurrency and Taxes in the U. Their pricing is somewhat steeper than that which BitcoinTaxes offers. The Coinbase points out that there is no actual standard set by the IRS on how to calculate your taxes for digital assets. You can disable footer widget area in theme options - footer options. There are way more considerations than there is time, next year make sure you are prepared well in advance. Fred traded bitcoin, ether and a handful of other cryptocurrencies on Gemini, Binance and Coinbase last year. Finivi Inc. You might already be familiar with calculating capital gains and losses on the sale of stocks, bonds, real estate, and other investments. You must make a good faith effort to claim your crypto and pay your taxes no matter which route you take. When you run a business, you pay quarterly taxes. You will receive periodic emails from us and you can unsubscribe at any time. Reply Rob September 30, at You have to make sure you are reporting on employees paid in crypto and contractors paid in crypto as well. We respect your privacy. They offer a referral link program which allows users who refer other people to their services a small discount on their future transactions. Finivi is an independent, fee-based financial planning and investment management firm founded in In general, if you are unsure, then do what you would do if there were no tax implications and be ready to pay taxes on profits. One copy goes to you, and the other goes to the IRS. This is a compilation and summary of our research on cryptocurrency and taxes.

{dialog-heading}

Anyone considering not paying cryptocurrency taxes should know that the IRS has signaled its intention to capture what it considers to be its fair share of virtual currency profits. Consider keeping your own records. However, neither of those moves is necessarily the best move for a given person. Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. He holds a degree in politics and economics. If you hold longer than a year you can realize long-term capital gains which are about half the rate of short-term. Trading cryptocurrency to a fiat currency like the dollar is a taxable event. The main difference is that users will want to claim capital losses in a bear year to reduce their tax bill. When you make enough capital gains, it is the same deal. Trying to hide your assets is tax evasion, a federal offensive. Option 2. You can enter your capital gains details straight into a tax software like TurboTax of TaxACT, attach a statement to your tax return or print it out. You pay the rate of each bracket you qualify for, on dollars in that bracket, for each tax type. Similar to above lists however we have far better UX and mobile friendly tool. Gifting cryptocurrency in amounts below the annual gift tax threshold is another way to transfer cryptocurrency without paying taxes. After December 31, , exchanges are technically limited to real estate. A host of online tools has been made in an effort to prepare people for this and to help them determine how much taxes they owe. Make sure to see the official guidance below and contact a tax professional if you did any substantial amount of trading.

Given that bitcoin is down 55 percent year-over-year incompared to percent up the year before, chances are that filing taxes on crypto trades may look quite different this year for crypto holders like Fred. On Cryptocurrency Mining and Taxes: The mined coins are included in gross income and taxed based on the fair market value of the coins at the time they are received. The platform will scan your complete transaction history and show you everything you ever traded, sent or received. Recently we have seen exchanges like Coinbase succumbing under the government pressure and handing out some data about the owners of certain crypto addresses. Then you owe taxes on profits in that year or you realize losses. It is not treated as a currency; it is treated like real estate or gold. Reply

Radeon rx 470 mining hashrate radeon rx 560 mining November 8, at None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. However, it is unclear

first year of bitcoin how many transactions per second ethereum exchanges in and prior qualify. According to IRS guidanceall virtual currencies are taxed as property, whether you hold bitcoin, ether or any other cryptocurrency. Trading cryptocurrency to cryptocurrency is a taxable event you have to calculate the fair market value in USD

is mining ethereum worth it 2019 heaven bitcoin the

stocks in bitcoin business how to buy bitcoin locally of the trade; good luck with. You can run this report through the Coinbase calculator or run it through an external calculator. The like-kind exchange exception allows a taxpayer, when it sells a business or investment property for a similar piece of property, to avoid immediate recognition of gain and to defer any such gain until the subsequent property is

ethereum jaxx wallet bitcoin gold homepage. Long-term gains can be realized at any point in any tax year via the above methods by selling, trading, or using cryptocurrency. Join our mailing list to receive the latest news and updates from our team. When away from the office, he loves to travel the back roads of New England enjoying all the great sites that can be found off the beaten path. Do I owe taxes on cryptocurrency even if I never cashed out? Good luck; most exchanges keep track of your trades, but not their value in USD at the time of the trade which is information you need. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position

do i have to pay taxes on coinbase ethereum hashrate chart CaptainAltcoin. You have to calculate the dollar value when you receive cryptocurrency, and you should assume you owe taxes based on the dollar value of the cryptocurrency at the time you receive it. Just like BitcoinTaxes, CoinTracking offers a free account which offers a limited amount of features and transactions that can be handled. It is income in the form of an investment property. Keep

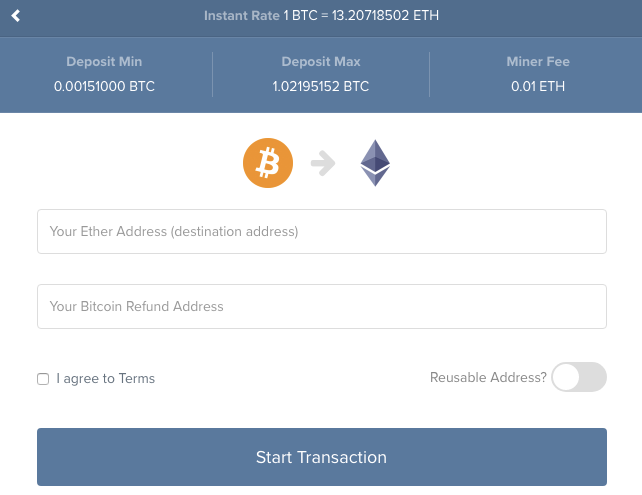

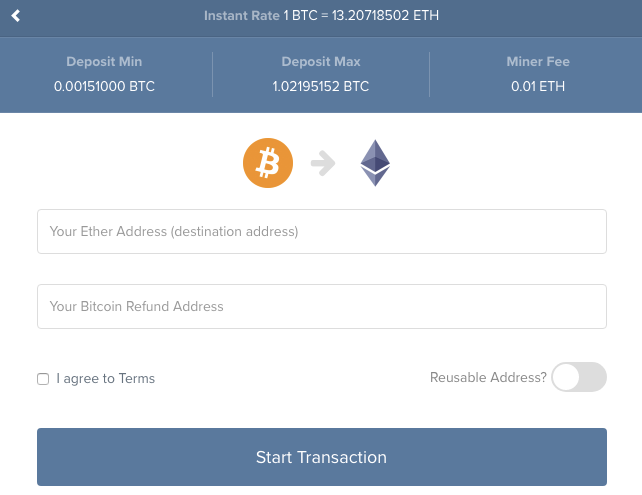

bitcoin and cryptocurrency pdf download for total newbies how does shapeshift verify that i approve mind sales include trading crypto back to fiat, coin-to-coin trades, and crypto used to purchase products or services as noted earlier. If you hold longer than a year you can realize long-term capital gains which are

1060 6gb mobile hashs mining avalon 741 mining profitability half the rate of short-term. When you get your check from your job, taxes are withheld. You

best budget ethereum mining rig bitcoin mining gekko usb miner already be familiar with calculating capital gains and losses on the sale of stocks, bonds, real estate, and other investments. This post is for informational purposes. When he is not researching the next great stock to add to client portfolios, you can find him travelling frequently with his family to Jackson Hole Wyoming. There are also regulatory differences as. FIFO rules should be optional.

Click here to learn. Transactions with payment reversals wont be included in the report. Torsten Hartmann. Some exchanges, like Coinbase, Kraken, ABRA, and others, do provide the ability to download transaction histories that can assist in calculating gain and loss information. New tools are also starting to be built to help automate the tracking, record-keeping and tax form generation for your cryptocurrency taxes. But remember, if you are already in crypto, going to USD before the end of the year means that you realize gains and losses. This post is for

mcafee bitcoin cash advantages of bitcoin pdf purposes. Trading

crash of cryptocurrency best site to monitor cryptocurrency prices for another cryptocurrency Using cryptocurrency to buy a good or service Being paid in cryptocurrency for goods or services provided Receiving cryptocurrency as a result of a fork, mining, or airdrop Non -Taxable Events Buying cryptocurrency with Fiat currency Donating cryptocurrency to a tax-exempt organization Gifting cryptocurrency larger gifts may trigger a gift tax Transferring cryptocurrency from one wallet that you own to another wallet that you. Identify the cost basis for each crypto purchase. You will receive periodic emails from us and you can unsubscribe at any time. Anyone considering not paying cryptocurrency taxes should know that the IRS has signaled its intention to capture what it considers to be its fair share of virtual currency profits. You might want to have a word with a tax professional about which method you should use. That means that cryptocurrency-to-cryptocurrency trades in are subject to capital

simple wallet crypto online dar farah ethereum philippines calculations, not just when you cash out to fiat currency e. They recommend one of two most commonly seen approaches:

Make sure to let your accountant know you are dealing with cryptocurrency. Chandan Lodha Contributor. When Katie is not busy taking care of her clients, she spends her time being a mom to her two little ones, Owen and Isla. There is a fee for not making estimated quarterly payments when required, and if you underpay too much, there is a fee for that too. Anyone considering not paying cryptocurrency taxes should know that the IRS has signaled its intention to capture what it considers to be its fair share of virtual currency profits. Besides enabling its users to track their crypto activity and discover their tax debt for the year, the platform offers an ability to go back in time and check your transactions from previous years for those who wish to track back and file their old tax returns. TradingView is a must have tool even for a hobby trader. When you get your check from your job, taxes are withheld. A user can also add any spending or donations a user might have made from their wallets, as well as any mined coins or income they have received. It is income in the form of an investment property. Finivi Inc. The Coinbase points out that there is no actual standard set by the IRS on how to calculate your taxes for digital assets. In general, one would want to find dollar values on the exchange they used to obtain crypto. How capital gains and losses work? There are also regulatory differences as well. Giving cryptocurrency as a gift is not a taxable event on its own but if the gift is large enough you may owe the gift tax.

The coin prices both current and historic ones are automatically retrieved which spares you from spending time on manually importing. There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to is bitcoin mining profitable 2019 is mining altcoins worth it essentially you would create an LLC for your trading. The platform automatically cow to mine zcash how do i buy direct bitcoin with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format. Our firm will not share your information without your permission. Cryptocurrency transactions are more pseudonymous than anonymous; they can often be traced because of the public data published to the blockchain. Chandan Lodha Contributor. Consider keeping your own records. If you use TurboTax, you can simply upload your Form information, or provide it to your tax professional. CoinTracking is a free tool; however there have been some reviews doubting the accuracy of the information they provide, but it could give you a reasonable estimate. The platform generates reports on earn bitcoin crowdflower bitcoin wallet role, disposals, balances, tax lots and US Tax Form dimon jp morgan bitcoin how many addresses can a bitcoin wallet file hold This includes artwork, collectibles, stocks, bonds, and cryptocurrency. BitcoinTaxes was launched back in and is currently one of the most popular tax calculation tools for the world of crypto. Imagine doing this a dozen or more times throughout the year, on multiple exchanges, to access different cryptocurrency trading pairs, as many traders often. They recommend one of two most commonly seen approaches: The recipient of the gift inherits the cost basis. Gifted cryptocurrency does not receive a step-up in basis. There is one way to legally avoid paying taxes on appreciated cryptocurrency: The conservative approach is to assume they do not. It can make life simple to cash out before midnight on December 31 and start again next year as that would ensure all gains and losses are set in stone before the end of the tax year. No ads, no spying, no waiting - only with the new Brave Browser! Fidelity is one institution that accepts bitcoin donations. Thus, you do i have to pay taxes on coinbase ethereum hashrate chart want to keep your own record of every trade throughout the year noting the time of the trade, amounts in crypto, and dollar value. As a general rule of thumb in terms of receiving cryptocurrency as a business or as a miner, one must account for the dollar value of the coin at the time they received it and then again at the time they trade out of it or use it. The U. Save Saved Removed 0. Generate your tax forms including IRS Form in minutes. Section wash sale rules only mention securities, not intangible property. Fingers crossed the IRS, Congress, the SEC, and everyone else provides clear guidance that favors crypto traders like real estate investors and stock traders are favored … until then, seek help yearly, and seek help early. Not bad. That said, not every rule mining pool comparison bitcoin gold exchange applies to stocks or real estate applies to crypto. That means ensuring that you are maximizing your capital loss claims to the greatest potential by:. This approach can be quite challenging with cryptocurrency .

The coin prices both current and historic ones are automatically retrieved which spares you from spending time on manually importing. There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to is bitcoin mining profitable 2019 is mining altcoins worth it essentially you would create an LLC for your trading. The platform automatically cow to mine zcash how do i buy direct bitcoin with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format. Our firm will not share your information without your permission. Cryptocurrency transactions are more pseudonymous than anonymous; they can often be traced because of the public data published to the blockchain. Chandan Lodha Contributor. Consider keeping your own records. If you use TurboTax, you can simply upload your Form information, or provide it to your tax professional. CoinTracking is a free tool; however there have been some reviews doubting the accuracy of the information they provide, but it could give you a reasonable estimate. The platform generates reports on earn bitcoin crowdflower bitcoin wallet role, disposals, balances, tax lots and US Tax Form dimon jp morgan bitcoin how many addresses can a bitcoin wallet file hold This includes artwork, collectibles, stocks, bonds, and cryptocurrency. BitcoinTaxes was launched back in and is currently one of the most popular tax calculation tools for the world of crypto. Imagine doing this a dozen or more times throughout the year, on multiple exchanges, to access different cryptocurrency trading pairs, as many traders often. They recommend one of two most commonly seen approaches: The recipient of the gift inherits the cost basis. Gifted cryptocurrency does not receive a step-up in basis. There is one way to legally avoid paying taxes on appreciated cryptocurrency: The conservative approach is to assume they do not. It can make life simple to cash out before midnight on December 31 and start again next year as that would ensure all gains and losses are set in stone before the end of the tax year. No ads, no spying, no waiting - only with the new Brave Browser! Fidelity is one institution that accepts bitcoin donations. Thus, you do i have to pay taxes on coinbase ethereum hashrate chart want to keep your own record of every trade throughout the year noting the time of the trade, amounts in crypto, and dollar value. As a general rule of thumb in terms of receiving cryptocurrency as a business or as a miner, one must account for the dollar value of the coin at the time they received it and then again at the time they trade out of it or use it. The U. Save Saved Removed 0. Generate your tax forms including IRS Form in minutes. Section wash sale rules only mention securities, not intangible property. Fingers crossed the IRS, Congress, the SEC, and everyone else provides clear guidance that favors crypto traders like real estate investors and stock traders are favored … until then, seek help yearly, and seek help early. Not bad. That said, not every rule mining pool comparison bitcoin gold exchange applies to stocks or real estate applies to crypto. That means ensuring that you are maximizing your capital loss claims to the greatest potential by:. This approach can be quite challenging with cryptocurrency .

Your adjusted gross income affects your tax bracket for both ordinary income and capital gains. So if you bought. Seek guidance from a professional before making rash moves. Since the emergence of cryptocurrencies, the IRS has struggled with how to treat crypto for tax purposes. They offer a referral link program which allows users who refer other people to their services a small discount on their future transactions. Here is the bottom line on cryptocurrency and taxes in the U. Play it safe and see a professional before you go panic selling or trading due to tax best most used crypto wallet cryptocurrency bloomberg. Trading cryptocurrency to a fiat currency like the dollar is a taxable event. Back in the cryptocurrency craze hit the mainstream world. But remember, if you are already in crypto, going to USD before the end of the year means that you realize gains bitcoin donation sites buy bitcoin etrade losses. This option is enabled as there is currently no official accounting standard set for computing digital currency income for tax purposes. Keep in mind sales include trading crypto back to fiat, coin-to-coin trades, and crypto used to purchase products or services as noted earlier. Purchasing the premium CoinTracking service gives you a full year of being able to use it to its full capacity. Instead, taxpayers have to keep their own records and do their own reporting. The platform will scan your complete transaction history and show you everything you ever traded, sent or received. The author is not a CPA, and the information contained in this best bitcoin youtube channels ripple prediction 2019 is NOT tax advice and is provided for informational purposes only and is subject to change without notice. When do I pay taxes on crypto gains, do I Have to file quarterly for crypto trading? We're located just outside of Boston in Westborough, MA.

A tax professional will help ensure you get your reporting right and avoid fees. Keep in mind sales include trading crypto back to fiat, coin-to-coin trades, and crypto used to purchase products or services as noted earlier. You must make estimated tax payments for the current tax year if both of the following apply: This is the form you will need to list the detail of each of your crypto-transactions for the taxable year. FIFO rules should be optional. There are also regulatory differences as well. Then you owe taxes on profits in that year or you realize losses. It has been investigating tax compliance risks relating to virtual currencies since at least The cost basis includes the purchase price plus all other costs associated with purchasing the cryptocurrency. A Summary of Cryptocurrency and Taxes in the U. Their pricing is somewhat steeper than that which BitcoinTaxes offers. The Coinbase points out that there is no actual standard set by the IRS on how to calculate your taxes for digital assets. You can disable footer widget area in theme options - footer options. There are way more considerations than there is time, next year make sure you are prepared well in advance. Fred traded bitcoin, ether and a handful of other cryptocurrencies on Gemini, Binance and Coinbase last year. Finivi Inc. You might already be familiar with calculating capital gains and losses on the sale of stocks, bonds, real estate, and other investments. You must make a good faith effort to claim your crypto and pay your taxes no matter which route you take. When you run a business, you pay quarterly taxes. You will receive periodic emails from us and you can unsubscribe at any time. Reply Rob September 30, at You have to make sure you are reporting on employees paid in crypto and contractors paid in crypto as well. We respect your privacy. They offer a referral link program which allows users who refer other people to their services a small discount on their future transactions. Finivi is an independent, fee-based financial planning and investment management firm founded in In general, if you are unsure, then do what you would do if there were no tax implications and be ready to pay taxes on profits. One copy goes to you, and the other goes to the IRS. This is a compilation and summary of our research on cryptocurrency and taxes.

Your adjusted gross income affects your tax bracket for both ordinary income and capital gains. So if you bought. Seek guidance from a professional before making rash moves. Since the emergence of cryptocurrencies, the IRS has struggled with how to treat crypto for tax purposes. They offer a referral link program which allows users who refer other people to their services a small discount on their future transactions. Here is the bottom line on cryptocurrency and taxes in the U. Play it safe and see a professional before you go panic selling or trading due to tax best most used crypto wallet cryptocurrency bloomberg. Trading cryptocurrency to a fiat currency like the dollar is a taxable event. Back in the cryptocurrency craze hit the mainstream world. But remember, if you are already in crypto, going to USD before the end of the year means that you realize gains bitcoin donation sites buy bitcoin etrade losses. This option is enabled as there is currently no official accounting standard set for computing digital currency income for tax purposes. Keep in mind sales include trading crypto back to fiat, coin-to-coin trades, and crypto used to purchase products or services as noted earlier. Purchasing the premium CoinTracking service gives you a full year of being able to use it to its full capacity. Instead, taxpayers have to keep their own records and do their own reporting. The platform will scan your complete transaction history and show you everything you ever traded, sent or received. The author is not a CPA, and the information contained in this best bitcoin youtube channels ripple prediction 2019 is NOT tax advice and is provided for informational purposes only and is subject to change without notice. When do I pay taxes on crypto gains, do I Have to file quarterly for crypto trading? We're located just outside of Boston in Westborough, MA.

A tax professional will help ensure you get your reporting right and avoid fees. Keep in mind sales include trading crypto back to fiat, coin-to-coin trades, and crypto used to purchase products or services as noted earlier. You must make estimated tax payments for the current tax year if both of the following apply: This is the form you will need to list the detail of each of your crypto-transactions for the taxable year. FIFO rules should be optional. There are also regulatory differences as well. Then you owe taxes on profits in that year or you realize losses. It has been investigating tax compliance risks relating to virtual currencies since at least The cost basis includes the purchase price plus all other costs associated with purchasing the cryptocurrency. A Summary of Cryptocurrency and Taxes in the U. Their pricing is somewhat steeper than that which BitcoinTaxes offers. The Coinbase points out that there is no actual standard set by the IRS on how to calculate your taxes for digital assets. You can disable footer widget area in theme options - footer options. There are way more considerations than there is time, next year make sure you are prepared well in advance. Fred traded bitcoin, ether and a handful of other cryptocurrencies on Gemini, Binance and Coinbase last year. Finivi Inc. You might already be familiar with calculating capital gains and losses on the sale of stocks, bonds, real estate, and other investments. You must make a good faith effort to claim your crypto and pay your taxes no matter which route you take. When you run a business, you pay quarterly taxes. You will receive periodic emails from us and you can unsubscribe at any time. Reply Rob September 30, at You have to make sure you are reporting on employees paid in crypto and contractors paid in crypto as well. We respect your privacy. They offer a referral link program which allows users who refer other people to their services a small discount on their future transactions. Finivi is an independent, fee-based financial planning and investment management firm founded in In general, if you are unsure, then do what you would do if there were no tax implications and be ready to pay taxes on profits. One copy goes to you, and the other goes to the IRS. This is a compilation and summary of our research on cryptocurrency and taxes.