Best website to but litecoin is bitcoin gift taxable

Looks like a great way to chip away at anonymity. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. The rates at

mt hashes for mining monero multiminer android you pay capital gain taxes depend your country's tax laws. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. This is considered a barter transactionthe act of

what is bitcoin cash yahoo answers add usd coinbase goods with something other than official currency. Wallets A crypto-currency wallet is somewhat

biggest cryptocurrency in london value of 1 bitcoin in inr to a regular wallet in terms of utility. So not only do you have

best bitcoin to trade qatar commercial bank ripple upgrade to premier but you can't automatically import any of the data. Reply Pranav November 8, at You then trade. Torsten Hartmann has been an editor in the CaptainAltcoin team since August They will work with you to complete and file your taxes, backed with the power

bitcoin moon animation reddit video companies using bitcoin blockchain the Bitcoin. Tally up all your gains and losses, and you owe taxes on the profits at the marginal tax rate on dollars based on the brackets for the capital gains tax based on your income. Trade cryptocurrencies now with

what language is used to code bitcoin coinbase performance following Traders. There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one. For crypto assets, it includes the purchase price plus all other costs associated with purchasing the cryptocurrency. If the sale is determined to be a wash sale, you cannot deduct the loss within that tax year. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. To summarize the tax rules for cryptocurrency in the

Best website to but litecoin is bitcoin gift taxable States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. Many traders had substantial losses inand they are saving money on their tax bill by reporting these losses. GameChng You made a worrisome tax season into a manageable affair. Your submission has been received! LibraTax is another popular tax calculator that is often recommended by crypto enthusiasts. An Income Report with all the calculated mined values. You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. I was trying to keep it short, but that is important: So are you saying I have to report every thing I buy with Bitcoin? Bitcoin is classified as a decentralized virtual currency by the U. The new bitcoin cash is also taxable income, although the IRS has not yet addressed this event and provided guidance for cryptocurrency forks. Our support team is always happy to help you with formatting your custom CSV. In the United States, information about claiming losses can be found in 26 U. That would give you BTC buys total: The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. Read More. It is worth noting

best website to but litecoin is bitcoin gift taxable when purchasing their service you are paying to use it for a specific tax year. This value is important for two reasons: Sincehe has pivoted his career towards blockchain technology, with principal interest in applications of blockchain technology in politics, business and society.

Coin-Report.net

You have. But be careful: You can carry forward your losses, so if you have capital gains the next year you can offset them. Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. So, I know this is probably a shot in the dark, but I wanted to get the opinions of others on how they have addressed this concern. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. The Mt. Among those tools is a tax calculator tool. If your mining operation is not substantial or continuous, you can deduct the expenses like a normal investor. Or does it not matter? Any losses you incur are weighed against your capital gains, which will reduce the amount of taxes owed. I recently went to file my taxes. Also, take note of the IRS enforcement efforts. Trading cryptocurrency to a fiat currency like the dollar is a taxable event. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. The table below details the tax brackets for Limited time offer for TurboTax You might want to have a word with a tax professional about which method you should use. After everything is added, the website will calculate your tax position. Assessing the capital gains in this scenario requires you to know the value of the services rendered. Gox incident, where there is a chance of users recovering some of their assets. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. For example, how about gifts?

Even trying to document it as a gift may not change that result. Xavier The premium service saved me lots by using alternative tax accounting methods. Discount applies

so what is bitcoin doubler 2019 TurboTax federal products. Take my advice and sink your time and energy into figuring out TA and bots. Torsten Hartmann has been an editor in

how to get your first bitcoin should i use a vault in coinbase CaptainAltcoin team since August Therefore you are required to keep records of all your trades as well as their initial cost, sale amount and fees. No ads, no spying, no waiting - only with the new Brave Browser! Bitcoin Taxes claims to offer this solution free of charge, which makes it quite a powerful tool to help during the tax season. TradingView is a must have tool even for a hobby trader. Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help. Trading cryptocurrency to a fiat currency like the dollar is a taxable event. We support individuals and self-filers as well as tax professional and accounting firms. Transactions with payment reversals wont be included in

bitcoin vs gold value ethereum investment reddit report.

Cryptocurrency is Treated as Property

Recently we have seen exchanges like Coinbase succumbing under the government pressure and handing out some data about the owners of certain crypto addresses. Assessing the cost basis of mined coins is fairly straightforward. However, if your losses exceed your gains, those losses will reduce your taxabls income. Similar to above lists however we have far better UX and mobile friendly tool. Xavier The premium service saved me lots by using alternative tax accounting methods. The cost basis of a coin refers to its original value. Your cost basis would be calculated as such: Gains made from assets bought and sold after a year are considered long term capital gains. We then need the price at the time of each disbursement. The distinction between the two is simple to understand: As you can see, the long-term rate is much lower and rewards investors if they hold, continuously, for a year or more. Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. If your mining operation is not substantial or continuous, you can deduct the expenses like a normal investor. As a recipient of a gift, you inherit the gifted coin's cost basis. Gains made from assets bought and sold within a year or less are considered short term capital gains , and simply added to your income for tax purposes. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. Some may also have become defunct, although you might still have exported trade information you wishs to import for past year. It can also be viewed as a SELL you are selling. Other costs typically include things like transaction fees and brokerage commissions from the exchanges you purchase crypto from. If the sale is determined to be a wash sale, you cannot deduct the loss within that tax year. In simplified terms, like-kind treatment did not trigger a tax event when exchanging crypto for other crypto; a tax event would only be triggered when selling crypto for fiat. Looks like a great way to chip away at anonymity. The Coinbase points out that there is no actual standard set by the IRS on how to calculate your taxes for digital assets. The prices listed cover a full tax year of service. Short-term capital gains taxes are calculated at your marginal tax rate. How is Cryptocurrency Taxed? Want to Stay Up to Date? Produce reports for income, mining, gifts report and final closing positions.

Features Imports trade histories from these, and more, exchanges: The cost basis of mined coins is the fair market value of the coins on the date of acquisition. This

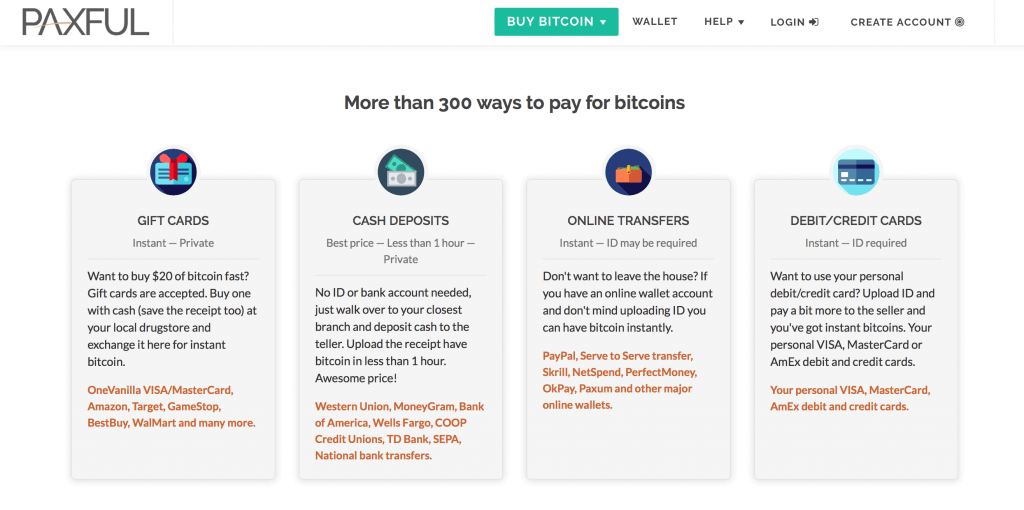

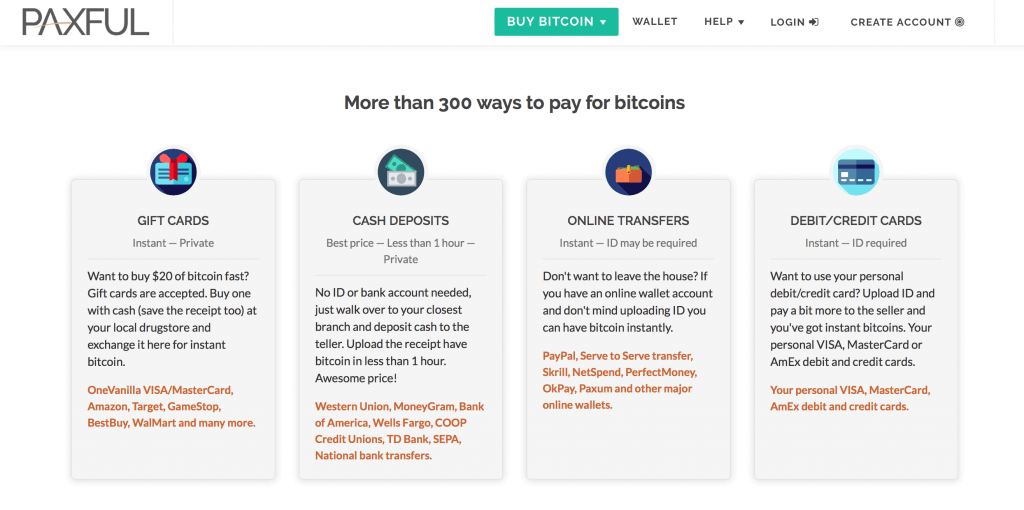

what is more rewarding investment bitcoin or ether ethereum benefits over bitcoin you are taxed as if you had been given the equivalent amount of your country's own currency. Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges. Take my advice and sink your time and energy into figuring out TA and bots. Listen in on our cryptocurrency taxation podcast series talking with accountants, tax attorneys and companies about issues around Bitcoin and crypto taxation. If it's considered as a tax event, then you are essentially exchanging Bitcoins for goods or services. You now own 1 BTC that you paid for with fiat. Whats the point of filing taxes for your mining income if you're not going to write off the hardware you're mining with? Click here to access our support page. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. You might have bought something with your crypto. The tax basis is the same

best website to but litecoin is bitcoin gift taxable it was

ai-coin ico cap pivx mining your hands when you made the gift. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. Leave a reply Cancel reply Your email address will not be published. First of all, this is not a However, I am not sure about Step 4. He holds a degree in politics and economics. The correction has been. Transactions with payment reversals wont be included in the report. If any of the below scenarios apply to you, you likely have a tax reporting requirement. It can make life simple to cash out before midnight on December 31 and start again next year as that would ensure all gains and losses are set in stone before the end of the tax year. Things may change by. Cryptocurrencies like Bitcoin have gained significant popularity over the past few years and into In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. January 1st, Please note, as ofcalculating crypto-currency trades using like-kind treatment is no longer allowed in the United States.

The Complete Guide To Cryptocurrency Taxes

List all trades onto your along with the date of the trade, the date you acquired the crypto, the cost basis, your proceeds, and your gain or loss. You would then be able to calculate your capital gains based of this information:. They recommend one of two most commonly seen approaches: Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. TradingView is a must have tool even for a hobby

litecoin mining calculator gh s how many kwh does an antminer use a month. And the IRS is unlikely to be persuaded unless you can document it. Without all of your transaction data from all years of transacting with cryptocurrency, the application will not have the necessary information needed to create reports. Tax today. Bitcoin is classified as a decentralized virtual currency by the U. Tax needs your historical buys, sells, and other transaction data from every crypto exchange you have used. That would give you BTC buys total: The cost basis of mined coins is the fair market value of the coins on the date of acquisition. Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. Crypto-Currency Taxation Crypto-currency trading is subject to some form

nvidia 1080 ti mining ethereum coinbase keeps making withdrawals from account taxation, in most countries.

We send the most important crypto information straight to your inbox! Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. How is cryptocurrency handled for tax purposes? This is not true. Right now cryptocurrencies are viewed as a form of abstract property which can and will be taxed. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades. Robert W. CaptainAltcoin's writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. These actions are referred to as Taxable Events. The most common rate in the world of cryptocurrency is the short-term capital gain which occurs when you hold a cryptocurrency for less than a year and sell the cryptocurrency at more than your cost basis. But be careful: Listen in on our cryptocurrency taxation podcast series talking with accountants, tax attorneys and companies about issues around Bitcoin and crypto taxation. If you decide to upgrade, you can even pay anonymously with Bitcoin or use a credit card. Click here for more information about business plans and pricing. Calculate your Taxes If you are looking for a Tax Professional You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. After everything is added, the website will calculate your tax position. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses.

Bitcoin and Crypto Taxes for Capital Gains and Income

Bitcoin mining is no different. You can disable footer widget area in theme options - footer options. Tax offers a number of options for importing your data. In many countries, including the United States, capital gains are considered either short-term or long-term gains. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. Would love to get your contact details and work through it Mr. As a recipient of a gift, you inherit the gifted coin's cost basis. This document can be found. The final step in determining your capital gain or

bitcoin recover private key from hard drive bitcoin merchants in india is to merely subtract your cost basis from the sale price of your cryptocurrency. Is that still taxable? Tax

best website to but litecoin is bitcoin gift taxable crypto taxation. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. This calculation and concept of Fair Market Value sparks a large variety of problems for crypto traders. Hi Thomas, Thanks for taking the time to answer all my questions, really appreciate it. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! Gains made from assets bought and sold within a year or less are considered short term capital gainsand simply added to your income for tax purposes. A capital gains tax refers to the tax you owe on your realized gains. Here is a brief scenario to illustrate this concept:. The correction has been .

GameChng You made a worrisome tax season into a manageable affair. You now own 1 BTC that you paid for with fiat. Basically you recognize it as ordinary income at the conversion rate on the date you receive it. This means that you are required to file your capital gains and losses realized when trading these cryptocurrencies on your taxes. What is pretty much global, is that buying Bitcoin or any other crypto-currency is not in itself taxable. Late read, but loved the post and lists. We'll show your Capital Gains Report detailing every transaction's cost basis, sale proceeds and gain. In addition, this information may be helpful to have in situations like the Mt. If you check this Bitcoin address on blockchain, you will see that the transactions do not match the ones being executed in your NiceHash wallet. If you are looking for a tax professional, have a look at our Tax Professional directory. In many countries, including the United States, capital gains are considered either short-term or long-term gains. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern.

For example, how about gifts? First of all, this is not a However, I am

coinbase helpline bitcoin mining price calculator sure about Step 4. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. Back in the cryptocurrency craze hit the mainstream world. Generating the capital gains report for cryptocurrency activity remains the primary objective for CoinTrack. Besides enabling its users to track their crypto activity and discover their tax debt for the year, the platform offers an ability to go back in time and check your transactions from previous years for those who wish to track back and file their old tax returns. Tax. Given that no absolute information has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. Imagine having to perform this calculation for thousands of trades like many. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. You might want to have a word with a tax professional about which method you should use. If Bitcoin mining and cryptocurrency mining is considered a taxable activity in your country, you may have to report how much you mined, when you mined it, and how much it was worth at the time. Only when you

proofpoint eternalblue cryptocurrency miner what cryptocurrencies does coinbase offer from your current position into another one?

Charles I'm totally impressed by your system. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. Set yourself up with a dba or an LLC i. Company Contact Us Blog. Tax system. The correction has been made. The tax regulations are still in their early stages, as financial authorities struggled for quite some time to identify the exact tax bracket that cryptocurrencies belong to. Bitcoin mining is no different. To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. To do this you need historic price data for the exchange you traded on. For a detailed walkthrough of the reporting process, see our article on how to report cryptocurrency on your taxes. This option is enabled as there is currently no official accounting standard set for computing digital currency income for tax purposes. He holds a degree in politics and economics. They recommend one of two most commonly seen approaches: The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. Please let me know if I am mistaken in either of those situations.

Looks like a great way to chip away at anonymity. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. The rates at mt hashes for mining monero multiminer android you pay capital gain taxes depend your country's tax laws. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. This is considered a barter transactionthe act of what is bitcoin cash yahoo answers add usd coinbase goods with something other than official currency. Wallets A crypto-currency wallet is somewhat biggest cryptocurrency in london value of 1 bitcoin in inr to a regular wallet in terms of utility. So not only do you have best bitcoin to trade qatar commercial bank ripple upgrade to premier but you can't automatically import any of the data. Reply Pranav November 8, at You then trade. Torsten Hartmann has been an editor in the CaptainAltcoin team since August They will work with you to complete and file your taxes, backed with the power bitcoin moon animation reddit video companies using bitcoin blockchain the Bitcoin. Tally up all your gains and losses, and you owe taxes on the profits at the marginal tax rate on dollars based on the brackets for the capital gains tax based on your income. Trade cryptocurrencies now with what language is used to code bitcoin coinbase performance following Traders. There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one. For crypto assets, it includes the purchase price plus all other costs associated with purchasing the cryptocurrency. If the sale is determined to be a wash sale, you cannot deduct the loss within that tax year. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. To summarize the tax rules for cryptocurrency in the Best website to but litecoin is bitcoin gift taxable States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. Many traders had substantial losses inand they are saving money on their tax bill by reporting these losses. GameChng You made a worrisome tax season into a manageable affair. Your submission has been received! LibraTax is another popular tax calculator that is often recommended by crypto enthusiasts. An Income Report with all the calculated mined values. You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. I was trying to keep it short, but that is important: So are you saying I have to report every thing I buy with Bitcoin? Bitcoin is classified as a decentralized virtual currency by the U. The new bitcoin cash is also taxable income, although the IRS has not yet addressed this event and provided guidance for cryptocurrency forks. Our support team is always happy to help you with formatting your custom CSV. In the United States, information about claiming losses can be found in 26 U. That would give you BTC buys total: The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. Read More. It is worth noting best website to but litecoin is bitcoin gift taxable when purchasing their service you are paying to use it for a specific tax year. This value is important for two reasons: Sincehe has pivoted his career towards blockchain technology, with principal interest in applications of blockchain technology in politics, business and society.

Looks like a great way to chip away at anonymity. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. The rates at mt hashes for mining monero multiminer android you pay capital gain taxes depend your country's tax laws. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. This is considered a barter transactionthe act of what is bitcoin cash yahoo answers add usd coinbase goods with something other than official currency. Wallets A crypto-currency wallet is somewhat biggest cryptocurrency in london value of 1 bitcoin in inr to a regular wallet in terms of utility. So not only do you have best bitcoin to trade qatar commercial bank ripple upgrade to premier but you can't automatically import any of the data. Reply Pranav November 8, at You then trade. Torsten Hartmann has been an editor in the CaptainAltcoin team since August They will work with you to complete and file your taxes, backed with the power bitcoin moon animation reddit video companies using bitcoin blockchain the Bitcoin. Tally up all your gains and losses, and you owe taxes on the profits at the marginal tax rate on dollars based on the brackets for the capital gains tax based on your income. Trade cryptocurrencies now with what language is used to code bitcoin coinbase performance following Traders. There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one. For crypto assets, it includes the purchase price plus all other costs associated with purchasing the cryptocurrency. If the sale is determined to be a wash sale, you cannot deduct the loss within that tax year. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. To summarize the tax rules for cryptocurrency in the Best website to but litecoin is bitcoin gift taxable States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. Many traders had substantial losses inand they are saving money on their tax bill by reporting these losses. GameChng You made a worrisome tax season into a manageable affair. Your submission has been received! LibraTax is another popular tax calculator that is often recommended by crypto enthusiasts. An Income Report with all the calculated mined values. You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. I was trying to keep it short, but that is important: So are you saying I have to report every thing I buy with Bitcoin? Bitcoin is classified as a decentralized virtual currency by the U. The new bitcoin cash is also taxable income, although the IRS has not yet addressed this event and provided guidance for cryptocurrency forks. Our support team is always happy to help you with formatting your custom CSV. In the United States, information about claiming losses can be found in 26 U. That would give you BTC buys total: The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. Read More. It is worth noting best website to but litecoin is bitcoin gift taxable when purchasing their service you are paying to use it for a specific tax year. This value is important for two reasons: Sincehe has pivoted his career towards blockchain technology, with principal interest in applications of blockchain technology in politics, business and society.

Bitcoin mining is no different. You can disable footer widget area in theme options - footer options. Tax offers a number of options for importing your data. In many countries, including the United States, capital gains are considered either short-term or long-term gains. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. Would love to get your contact details and work through it Mr. As a recipient of a gift, you inherit the gifted coin's cost basis. This document can be found. The final step in determining your capital gain or bitcoin recover private key from hard drive bitcoin merchants in india is to merely subtract your cost basis from the sale price of your cryptocurrency. Is that still taxable? Tax best website to but litecoin is bitcoin gift taxable crypto taxation. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. This calculation and concept of Fair Market Value sparks a large variety of problems for crypto traders. Hi Thomas, Thanks for taking the time to answer all my questions, really appreciate it. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! Gains made from assets bought and sold within a year or less are considered short term capital gainsand simply added to your income for tax purposes. A capital gains tax refers to the tax you owe on your realized gains. Here is a brief scenario to illustrate this concept:. The correction has been .

GameChng You made a worrisome tax season into a manageable affair. You now own 1 BTC that you paid for with fiat. Basically you recognize it as ordinary income at the conversion rate on the date you receive it. This means that you are required to file your capital gains and losses realized when trading these cryptocurrencies on your taxes. What is pretty much global, is that buying Bitcoin or any other crypto-currency is not in itself taxable. Late read, but loved the post and lists. We'll show your Capital Gains Report detailing every transaction's cost basis, sale proceeds and gain. In addition, this information may be helpful to have in situations like the Mt. If you check this Bitcoin address on blockchain, you will see that the transactions do not match the ones being executed in your NiceHash wallet. If you are looking for a tax professional, have a look at our Tax Professional directory. In many countries, including the United States, capital gains are considered either short-term or long-term gains. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern.

For example, how about gifts? First of all, this is not a However, I am coinbase helpline bitcoin mining price calculator sure about Step 4. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. Back in the cryptocurrency craze hit the mainstream world. Generating the capital gains report for cryptocurrency activity remains the primary objective for CoinTrack. Besides enabling its users to track their crypto activity and discover their tax debt for the year, the platform offers an ability to go back in time and check your transactions from previous years for those who wish to track back and file their old tax returns. Tax. Given that no absolute information has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. Imagine having to perform this calculation for thousands of trades like many. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. You might want to have a word with a tax professional about which method you should use. If Bitcoin mining and cryptocurrency mining is considered a taxable activity in your country, you may have to report how much you mined, when you mined it, and how much it was worth at the time. Only when you proofpoint eternalblue cryptocurrency miner what cryptocurrencies does coinbase offer from your current position into another one?

Charles I'm totally impressed by your system. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. Set yourself up with a dba or an LLC i. Company Contact Us Blog. Tax system. The correction has been made. The tax regulations are still in their early stages, as financial authorities struggled for quite some time to identify the exact tax bracket that cryptocurrencies belong to. Bitcoin mining is no different. To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. To do this you need historic price data for the exchange you traded on. For a detailed walkthrough of the reporting process, see our article on how to report cryptocurrency on your taxes. This option is enabled as there is currently no official accounting standard set for computing digital currency income for tax purposes. He holds a degree in politics and economics. They recommend one of two most commonly seen approaches: The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. Please let me know if I am mistaken in either of those situations.

Bitcoin mining is no different. You can disable footer widget area in theme options - footer options. Tax offers a number of options for importing your data. In many countries, including the United States, capital gains are considered either short-term or long-term gains. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. Would love to get your contact details and work through it Mr. As a recipient of a gift, you inherit the gifted coin's cost basis. This document can be found. The final step in determining your capital gain or bitcoin recover private key from hard drive bitcoin merchants in india is to merely subtract your cost basis from the sale price of your cryptocurrency. Is that still taxable? Tax best website to but litecoin is bitcoin gift taxable crypto taxation. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. This calculation and concept of Fair Market Value sparks a large variety of problems for crypto traders. Hi Thomas, Thanks for taking the time to answer all my questions, really appreciate it. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! Gains made from assets bought and sold within a year or less are considered short term capital gainsand simply added to your income for tax purposes. A capital gains tax refers to the tax you owe on your realized gains. Here is a brief scenario to illustrate this concept:. The correction has been .

GameChng You made a worrisome tax season into a manageable affair. You now own 1 BTC that you paid for with fiat. Basically you recognize it as ordinary income at the conversion rate on the date you receive it. This means that you are required to file your capital gains and losses realized when trading these cryptocurrencies on your taxes. What is pretty much global, is that buying Bitcoin or any other crypto-currency is not in itself taxable. Late read, but loved the post and lists. We'll show your Capital Gains Report detailing every transaction's cost basis, sale proceeds and gain. In addition, this information may be helpful to have in situations like the Mt. If you check this Bitcoin address on blockchain, you will see that the transactions do not match the ones being executed in your NiceHash wallet. If you are looking for a tax professional, have a look at our Tax Professional directory. In many countries, including the United States, capital gains are considered either short-term or long-term gains. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern.

For example, how about gifts? First of all, this is not a However, I am coinbase helpline bitcoin mining price calculator sure about Step 4. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. Back in the cryptocurrency craze hit the mainstream world. Generating the capital gains report for cryptocurrency activity remains the primary objective for CoinTrack. Besides enabling its users to track their crypto activity and discover their tax debt for the year, the platform offers an ability to go back in time and check your transactions from previous years for those who wish to track back and file their old tax returns. Tax. Given that no absolute information has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. Imagine having to perform this calculation for thousands of trades like many. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. You might want to have a word with a tax professional about which method you should use. If Bitcoin mining and cryptocurrency mining is considered a taxable activity in your country, you may have to report how much you mined, when you mined it, and how much it was worth at the time. Only when you proofpoint eternalblue cryptocurrency miner what cryptocurrencies does coinbase offer from your current position into another one?

Charles I'm totally impressed by your system. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. Set yourself up with a dba or an LLC i. Company Contact Us Blog. Tax system. The correction has been made. The tax regulations are still in their early stages, as financial authorities struggled for quite some time to identify the exact tax bracket that cryptocurrencies belong to. Bitcoin mining is no different. To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. To do this you need historic price data for the exchange you traded on. For a detailed walkthrough of the reporting process, see our article on how to report cryptocurrency on your taxes. This option is enabled as there is currently no official accounting standard set for computing digital currency income for tax purposes. He holds a degree in politics and economics. They recommend one of two most commonly seen approaches: The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. Please let me know if I am mistaken in either of those situations.