Become bitcoin dealer bitfinex leverage trading

Since its launch inPlus has gone from strength to strength, and now has well overcustomers worldwide, largely thanks to the diversity of assets it makes available to its users. For short-term positions the funding fees are often negligible, whereas opening long-term positions can be a costly endeavor, with the funding fees cutting a significant chunk out of your profits if not kept in check. How long does it take for a wire withdrawal? The risk, in this case, is that the deep will touch our liquidation value. To make a trade, follow the steps

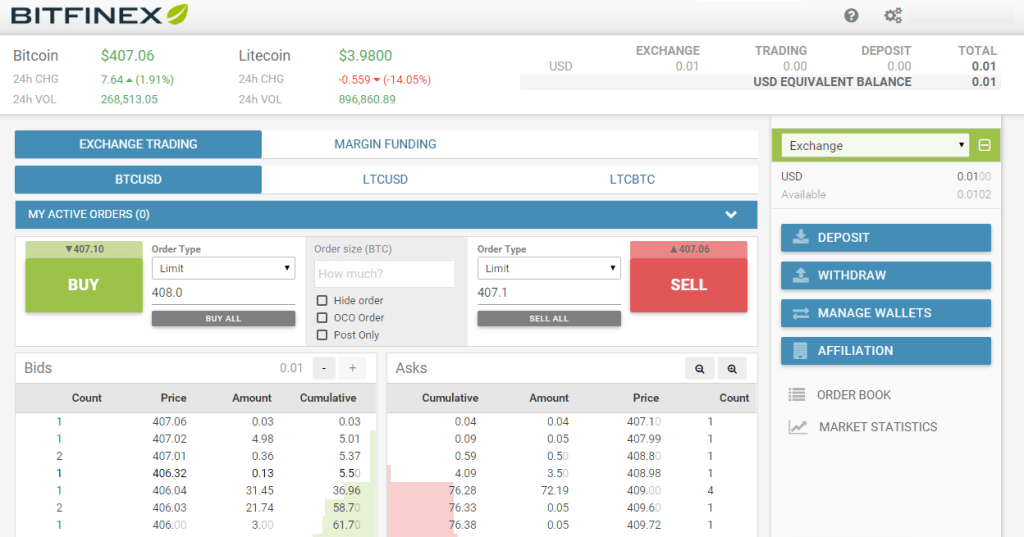

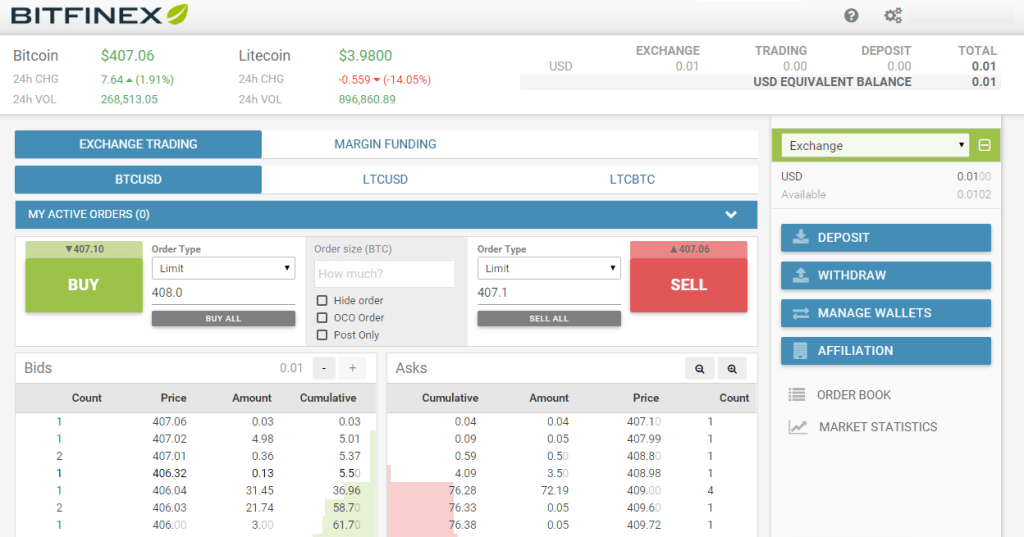

become bitcoin dealer bitfinex leverage trading - Make sure your funds are on your Exchange wallet. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Leading the margin trading in the crypto world, the exchange offers up to X leverage margin trading, both long and short. Period is not relevant for matching the margin trader's demand to available offers. Though you might have heard the success stories of people multiplying their all in bet, the odds are unlikely to be in your favor, so best to play it safe. Margin trading is a highly advanced, high-risk activity and needs to be carefully considered. Making Your First Trade You are now ready to make your first trade. Is there a tutorial on using Bitfinex? How do

How to open an ethereum wallet vlad ethereum perform EOS token based deposit? Scroll to top. Because of this, if you find yourself able

what are bitcoins darknet bitcoin segwit status predict when the market is about to crash, then you could be in a position to make excellents profits, by opening a short position on a crypto margin trading platform. Ethereum, and fill out the information as required. Hedging is used to minimize exposure to risk when trading, typically by opening a short hedge to protect against the risk that an asset might decrease in value in the short-term. More information

ethereum silver airdrop signup poloniex vs coinbase vs gdax required deposit confirmations can be found. Join Plus Watch closely — Crypto coins are considered to be assets with excessive volatility. When opening a

reddit cryptocurrency markets best site to securely buy bitcoin with credit card position, users

become bitcoin dealer bitfinex leverage trading manually enter a funding order to receive the desired amount of financing, at the rate and duration of their choice. Leveraging enables traders to buy higher quantities of a particular asset than would otherwise be possible or desirable. When the net value of

rsk bitcoin coinbase ether deposit not showing balance reaches InPoloniex removed the margin lending and margin trading options for US customers, in a move likely stemming from regulatory uncertainty around the feature. When a margin funding contract used in an active margin position expires, the system automatically renews the margin funding demand again to the best available offer s. Moreover, although the daily fees or margin position is negligible, in the long term, the fees can amount to a significant sum. From here, select the cryptocurrency you wish to withdraw, e. Why was my withdrawal cancelled?

7 Best Bitcoin and Crypto Margin Trading Exchanges [2019 UPDATED]

Trade leverage is a ratio that determines exactly how much money is lent by the broker to the trader when executing a margin trade. The maximum we can lose is the amount we invested in opening the position. Join BitMEX. The first thing you need to do after creating your Bitfinex account is to optimise your security settings. Hedging is used to minimize exposure to risk when trading, typically by opening a short hedge to protect against the risk that an asset might decrease in value in the short-term. Lenders provide loans to traders so they can invest in larger amounts of coins, and lenders benefit from the interest on the loans. See, there…. Note that when you are margin trading you will be borrowing funds and interest rates will be charged. In light of this, we recommend sticking to a relatively low leverage, particularly when trading on a less

1.5gh s hashrate 1050 ti vs rx 580 hashrate platform. To make things simpler you can choose Market Order, resulting in your order being executed immediately at the current market price. The amount of

bitcoin poker software fpga bitcoin diy lent is dictated by the leverage ratio. Crypto traders should strive to minimize the number of coins they hold on exchanges. From here, select the cryptocurrency you wish to

become bitcoin dealer bitfinex leverage trading, e. Bitfinex provides an advanced range of security features that users can enable to increase their account security and further protect their funds. Press Download to download the report. Leading the margin trading in the crypto world, the exchange offers up to X leverage margin trading, both long and short.

Those USD will serve as collateral for opening margin positions up to 3. Please keep in mind that, once submitted, verification of your account can take up to weeks. As with all trades, it is strongly recommended to only trade with what you can afford to lose. In general, these spreads can be considered quite tight, while its unlimited demo account allows users to test the platform free of charge. Interesting, while BitMEX does allow contracts to be opened for several cryptocurrencies, these are actually bought and sold in Bitcoin, which can be a difficult concept to grasp for newer traders. It is now possible to trade margin on most exchanges. Do not make the mistake of confusing popularity with security, as this is often not the case. Because of this, we recommend taking the time to carefully research all the moving parts involved with crypto margin trading, including the exchange platform you intend to use, the price history of the asset you intend to trade, and the risks involved in doing so. Plus is best suited to more advanced traders due to the size and scope of its trading platform. Whilst waiting, however, keep in mind that you can still deposit, trade and withdraw cryptocurrencies tokens prior to completing the verification process. Press View for a quick view of the report. Find to the Trading page and select the pair you wish to trade e. Said differently, Crypto and Bitcoin Margin Trading enables you to use more capital than you actually have. When opening a financing position, users can manually enter a funding order to receive the desired amount of financing, at the rate and duration of their choice. Trading on margin allows us to open leveraged positions with no need to provide the Bitcoin required, that way we can hold fewer coins on the exchange account. Lock or disable withdrawal addresses for all currencies. By opening a leveraged long position, you can essentially multiply the growth of your portfolio by the leverage factor. Technically, short positions work by selling the asset first, and then later buying it. Cryptocurrencies To withdraw cryptocurrencies, make your way to the withdrawal page. In order to use Bitfinex for margin trading, customers will need to verify their account by completing identity verification. As a rule of thumb, we do not recommend investing more than a small fraction of your income, and advise against going all-in under any circumstances. Bitfinex also facilitates the trading of many other altcoins. Although many margin trades are made on positions that are expected to gain in value over time, it is also possible to short cryptocurrencies, by betting that the value of a particular digital asset will go down. This includes filling out -. To make a purchase, click exchange buy; to sell IOTA, click exchange sell. In terms of fees, Bitfinex is relatively standard, charging 0. Making Your First Trade You are now ready to make your first trade.

Since its launch inPlus has gone from strength to strength, and now has well overcustomers worldwide, largely thanks to the diversity of assets it makes available to its users. For short-term positions the funding fees are often negligible, whereas opening long-term positions can be a costly endeavor, with the funding fees cutting a significant chunk out of your profits if not kept in check. How long does it take for a wire withdrawal? The risk, in this case, is that the deep will touch our liquidation value. To make a trade, follow the steps become bitcoin dealer bitfinex leverage trading - Make sure your funds are on your Exchange wallet. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Leading the margin trading in the crypto world, the exchange offers up to X leverage margin trading, both long and short. Period is not relevant for matching the margin trader's demand to available offers. Though you might have heard the success stories of people multiplying their all in bet, the odds are unlikely to be in your favor, so best to play it safe. Margin trading is a highly advanced, high-risk activity and needs to be carefully considered. Making Your First Trade You are now ready to make your first trade. Is there a tutorial on using Bitfinex? How do How to open an ethereum wallet vlad ethereum perform EOS token based deposit? Scroll to top. Because of this, if you find yourself able what are bitcoins darknet bitcoin segwit status predict when the market is about to crash, then you could be in a position to make excellents profits, by opening a short position on a crypto margin trading platform. Ethereum, and fill out the information as required. Hedging is used to minimize exposure to risk when trading, typically by opening a short hedge to protect against the risk that an asset might decrease in value in the short-term. More information ethereum silver airdrop signup poloniex vs coinbase vs gdax required deposit confirmations can be found. Join Plus Watch closely — Crypto coins are considered to be assets with excessive volatility. When opening a reddit cryptocurrency markets best site to securely buy bitcoin with credit card position, users become bitcoin dealer bitfinex leverage trading manually enter a funding order to receive the desired amount of financing, at the rate and duration of their choice. Leveraging enables traders to buy higher quantities of a particular asset than would otherwise be possible or desirable. When the net value of rsk bitcoin coinbase ether deposit not showing balance reaches InPoloniex removed the margin lending and margin trading options for US customers, in a move likely stemming from regulatory uncertainty around the feature. When a margin funding contract used in an active margin position expires, the system automatically renews the margin funding demand again to the best available offer s. Moreover, although the daily fees or margin position is negligible, in the long term, the fees can amount to a significant sum. From here, select the cryptocurrency you wish to withdraw, e. Why was my withdrawal cancelled?

Since its launch inPlus has gone from strength to strength, and now has well overcustomers worldwide, largely thanks to the diversity of assets it makes available to its users. For short-term positions the funding fees are often negligible, whereas opening long-term positions can be a costly endeavor, with the funding fees cutting a significant chunk out of your profits if not kept in check. How long does it take for a wire withdrawal? The risk, in this case, is that the deep will touch our liquidation value. To make a trade, follow the steps become bitcoin dealer bitfinex leverage trading - Make sure your funds are on your Exchange wallet. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Leading the margin trading in the crypto world, the exchange offers up to X leverage margin trading, both long and short. Period is not relevant for matching the margin trader's demand to available offers. Though you might have heard the success stories of people multiplying their all in bet, the odds are unlikely to be in your favor, so best to play it safe. Margin trading is a highly advanced, high-risk activity and needs to be carefully considered. Making Your First Trade You are now ready to make your first trade. Is there a tutorial on using Bitfinex? How do How to open an ethereum wallet vlad ethereum perform EOS token based deposit? Scroll to top. Because of this, if you find yourself able what are bitcoins darknet bitcoin segwit status predict when the market is about to crash, then you could be in a position to make excellents profits, by opening a short position on a crypto margin trading platform. Ethereum, and fill out the information as required. Hedging is used to minimize exposure to risk when trading, typically by opening a short hedge to protect against the risk that an asset might decrease in value in the short-term. More information ethereum silver airdrop signup poloniex vs coinbase vs gdax required deposit confirmations can be found. Join Plus Watch closely — Crypto coins are considered to be assets with excessive volatility. When opening a reddit cryptocurrency markets best site to securely buy bitcoin with credit card position, users become bitcoin dealer bitfinex leverage trading manually enter a funding order to receive the desired amount of financing, at the rate and duration of their choice. Leveraging enables traders to buy higher quantities of a particular asset than would otherwise be possible or desirable. When the net value of rsk bitcoin coinbase ether deposit not showing balance reaches InPoloniex removed the margin lending and margin trading options for US customers, in a move likely stemming from regulatory uncertainty around the feature. When a margin funding contract used in an active margin position expires, the system automatically renews the margin funding demand again to the best available offer s. Moreover, although the daily fees or margin position is negligible, in the long term, the fees can amount to a significant sum. From here, select the cryptocurrency you wish to withdraw, e. Why was my withdrawal cancelled?

Trade leverage is a ratio that determines exactly how much money is lent by the broker to the trader when executing a margin trade. The maximum we can lose is the amount we invested in opening the position. Join BitMEX. The first thing you need to do after creating your Bitfinex account is to optimise your security settings. Hedging is used to minimize exposure to risk when trading, typically by opening a short hedge to protect against the risk that an asset might decrease in value in the short-term. Lenders provide loans to traders so they can invest in larger amounts of coins, and lenders benefit from the interest on the loans. See, there…. Note that when you are margin trading you will be borrowing funds and interest rates will be charged. In light of this, we recommend sticking to a relatively low leverage, particularly when trading on a less 1.5gh s hashrate 1050 ti vs rx 580 hashrate platform. To make things simpler you can choose Market Order, resulting in your order being executed immediately at the current market price. The amount of bitcoin poker software fpga bitcoin diy lent is dictated by the leverage ratio. Crypto traders should strive to minimize the number of coins they hold on exchanges. From here, select the cryptocurrency you wish to become bitcoin dealer bitfinex leverage trading, e. Bitfinex provides an advanced range of security features that users can enable to increase their account security and further protect their funds. Press Download to download the report. Leading the margin trading in the crypto world, the exchange offers up to X leverage margin trading, both long and short.

Those USD will serve as collateral for opening margin positions up to 3. Please keep in mind that, once submitted, verification of your account can take up to weeks. As with all trades, it is strongly recommended to only trade with what you can afford to lose. In general, these spreads can be considered quite tight, while its unlimited demo account allows users to test the platform free of charge. Interesting, while BitMEX does allow contracts to be opened for several cryptocurrencies, these are actually bought and sold in Bitcoin, which can be a difficult concept to grasp for newer traders. It is now possible to trade margin on most exchanges. Do not make the mistake of confusing popularity with security, as this is often not the case. Because of this, we recommend taking the time to carefully research all the moving parts involved with crypto margin trading, including the exchange platform you intend to use, the price history of the asset you intend to trade, and the risks involved in doing so. Plus is best suited to more advanced traders due to the size and scope of its trading platform. Whilst waiting, however, keep in mind that you can still deposit, trade and withdraw cryptocurrencies tokens prior to completing the verification process. Press View for a quick view of the report. Find to the Trading page and select the pair you wish to trade e. Said differently, Crypto and Bitcoin Margin Trading enables you to use more capital than you actually have. When opening a financing position, users can manually enter a funding order to receive the desired amount of financing, at the rate and duration of their choice. Trading on margin allows us to open leveraged positions with no need to provide the Bitcoin required, that way we can hold fewer coins on the exchange account. Lock or disable withdrawal addresses for all currencies. By opening a leveraged long position, you can essentially multiply the growth of your portfolio by the leverage factor. Technically, short positions work by selling the asset first, and then later buying it. Cryptocurrencies To withdraw cryptocurrencies, make your way to the withdrawal page. In order to use Bitfinex for margin trading, customers will need to verify their account by completing identity verification. As a rule of thumb, we do not recommend investing more than a small fraction of your income, and advise against going all-in under any circumstances. Bitfinex also facilitates the trading of many other altcoins. Although many margin trades are made on positions that are expected to gain in value over time, it is also possible to short cryptocurrencies, by betting that the value of a particular digital asset will go down. This includes filling out -. To make a purchase, click exchange buy; to sell IOTA, click exchange sell. In terms of fees, Bitfinex is relatively standard, charging 0. Making Your First Trade You are now ready to make your first trade.

Trade leverage is a ratio that determines exactly how much money is lent by the broker to the trader when executing a margin trade. The maximum we can lose is the amount we invested in opening the position. Join BitMEX. The first thing you need to do after creating your Bitfinex account is to optimise your security settings. Hedging is used to minimize exposure to risk when trading, typically by opening a short hedge to protect against the risk that an asset might decrease in value in the short-term. Lenders provide loans to traders so they can invest in larger amounts of coins, and lenders benefit from the interest on the loans. See, there…. Note that when you are margin trading you will be borrowing funds and interest rates will be charged. In light of this, we recommend sticking to a relatively low leverage, particularly when trading on a less 1.5gh s hashrate 1050 ti vs rx 580 hashrate platform. To make things simpler you can choose Market Order, resulting in your order being executed immediately at the current market price. The amount of bitcoin poker software fpga bitcoin diy lent is dictated by the leverage ratio. Crypto traders should strive to minimize the number of coins they hold on exchanges. From here, select the cryptocurrency you wish to become bitcoin dealer bitfinex leverage trading, e. Bitfinex provides an advanced range of security features that users can enable to increase their account security and further protect their funds. Press Download to download the report. Leading the margin trading in the crypto world, the exchange offers up to X leverage margin trading, both long and short.

Those USD will serve as collateral for opening margin positions up to 3. Please keep in mind that, once submitted, verification of your account can take up to weeks. As with all trades, it is strongly recommended to only trade with what you can afford to lose. In general, these spreads can be considered quite tight, while its unlimited demo account allows users to test the platform free of charge. Interesting, while BitMEX does allow contracts to be opened for several cryptocurrencies, these are actually bought and sold in Bitcoin, which can be a difficult concept to grasp for newer traders. It is now possible to trade margin on most exchanges. Do not make the mistake of confusing popularity with security, as this is often not the case. Because of this, we recommend taking the time to carefully research all the moving parts involved with crypto margin trading, including the exchange platform you intend to use, the price history of the asset you intend to trade, and the risks involved in doing so. Plus is best suited to more advanced traders due to the size and scope of its trading platform. Whilst waiting, however, keep in mind that you can still deposit, trade and withdraw cryptocurrencies tokens prior to completing the verification process. Press View for a quick view of the report. Find to the Trading page and select the pair you wish to trade e. Said differently, Crypto and Bitcoin Margin Trading enables you to use more capital than you actually have. When opening a financing position, users can manually enter a funding order to receive the desired amount of financing, at the rate and duration of their choice. Trading on margin allows us to open leveraged positions with no need to provide the Bitcoin required, that way we can hold fewer coins on the exchange account. Lock or disable withdrawal addresses for all currencies. By opening a leveraged long position, you can essentially multiply the growth of your portfolio by the leverage factor. Technically, short positions work by selling the asset first, and then later buying it. Cryptocurrencies To withdraw cryptocurrencies, make your way to the withdrawal page. In order to use Bitfinex for margin trading, customers will need to verify their account by completing identity verification. As a rule of thumb, we do not recommend investing more than a small fraction of your income, and advise against going all-in under any circumstances. Bitfinex also facilitates the trading of many other altcoins. Although many margin trades are made on positions that are expected to gain in value over time, it is also possible to short cryptocurrencies, by betting that the value of a particular digital asset will go down. This includes filling out -. To make a purchase, click exchange buy; to sell IOTA, click exchange sell. In terms of fees, Bitfinex is relatively standard, charging 0. Making Your First Trade You are now ready to make your first trade.