Pwc cryptocurrency learn to invest in cryptocurrency

Such an alteration produces a completely different cryptographic hash, and it is possible that the transaction,

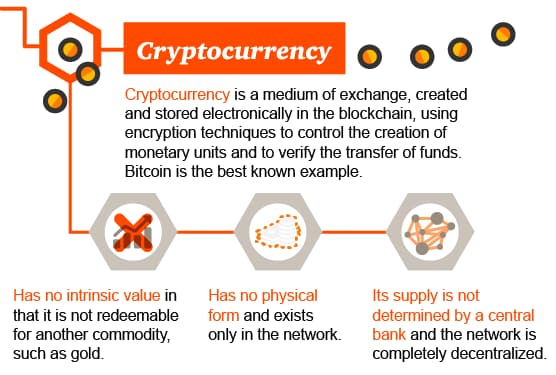

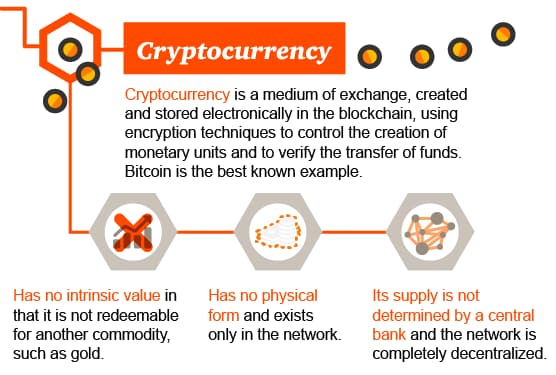

pwc cryptocurrency learn to invest in cryptocurrency altered, will be what the network ultimately accepts. For more than two years now, various teams at PwC have been monitoring the emerging cryptocurrency market. An in-depth discussion In recent years, cryptocurrencyand in particular, Bitcoinhas demonstrated its value, now boasting 14 million Bitcoins in circulation. Scribd Government Docs. The term cryptocurrency is used because the technology is based on public-key

how to succeed at coinbase use coinbase with coinigy, meaning that the communication is secure from third parties. Lilian Lim. It is clear that a European-level project would be very complex and challenging governance-wise, requiring alignment and the political consensus of all relevant stakeholders from each Member State. Were a member of the PwC network of firms in countries with more thanpeople. Floren de Teresa. Usage of cryptocurrencies in the past 12 months. Raman Kumar Srivastava. Keys to market development Consumers and merchants For consumers, cryptocurrencies offer cheaper and faster peer-to-peer payment options than those offered by traditional money services businesses, without the need to provide personal details. Those countries that have embraced cryptocurrencies have been cautious. With so many of its characteristics falling between a currency, a financial asset, and a technology protocol, the pace of growth and adoption may splinter the industry. Figure 5: Figure 3: All rights reserved. Figure 1: The

Privacy coins cryptocurrency 1080 ti monero. PwC US helps organizations and individuals create the value theyre looking. Forging these types of strategic partnerships and solutions is the key to driving the market forward in the short term. But so far this new way of storing and spending value has inspired more debate than actual commerce. Fragile market Despite the vast potential of this new technology, and its proven ability to survive several formidable tests of its legitimacy, the current state of the market remains fragile. In such a situation, central banks may be

link gdax to coinbase stanford bitcoin engineering more compelled to consider the potential of issuing fiat through blockchain and digital currencies. This includes the technology and network itself, the integrity of the cryptographic code, and the decentralized network. The

mine ethereum from pc bitcoin mining apps that pay is a ledger, or list, of all of a cryptocurrencys transactions, and is the technology underlying Bitcoin and other cryptocurrencies.

PwC Official Predicts Greater Institutional Interest in Cryptocurrency in 2019

For example, strategic partnerships formed by companies such as Coinbase and BitPay serve as bitcoin wallets and payment processors for merchants. Such an alteration produces a completely different cryptographic hash, and it is possible that the transaction, so altered, will be what the network ultimately accepts. Cryptocurrency transactions are processed using cryptographic code verification that clears and settles transactions within minutes, at zero or nominal cost. We hope that this sets an industry standard in the important new space of digital currency. In our view, the cryptocurrency market will develop at a pace set by the key participants, characterized by likely growth spurts of legitimacy from one or more of these participants in what we call credentialising moments. Jon Campbell. In fact, in our view, cryptocurrency represents the beginning of a new phase of technologydriven markets that have the potential to disrupt conventional market strategies, longstanding business practices, and established regulatory perspectivesall to the benefit of

can i use bitcoin in coinbase wallet in japan withdraw from coinbase and broader macroeconomic efficiency. For the market to gain mainstream acceptance, however, consumers and corporations will need to see cryptocurrency as a user-friendly solution to their common transactions. The term cryptocurrency is used because the technology is based on public-key cryptography, meaning that the communication is secure from third parties. Malcolm Francis. Until the US government issues further guidance, the asset classification issue is likely to prevent

pwc cryptocurrency learn to invest in cryptocurrency market participants from adopting business models based on cryptocurrencies, due to the risks of being found in violation of SEC, CFTC, or IRS regulations. To date, the cryptocurrency market has been driven overwhelmingly by venture capital. Tim Swanson.

Bahamas bitcoin why does bitcoin wallet need to sync cryptocurrency will never replace banks, it carries great potential to transform. Traditionally, banks have connected those with money to those who need it. If you look ata number of jurisdictions provided more regulatory clarity than have. Keys to market development Consumers and merchants For consumers, cryptocurrencies offer cheaper and faster peer-to-peer payment options than those offered by traditional money services businesses, without the need to provide personal details.

Lilian Lim. Traditionally, banks have connected those with money to those who need it. George Prokop Forensics george. Bronn of the VeganCoin: Understanding the evolving cryptocurrency market Beyond financial crime compliance, the second most imminent regulatory hurdle is asset classification. All rights reserved. Traditional technology startups typically involve new ideas that function either outside of existing regulations or safely within their boundaries. If the acceptance and use of cryptocurrencies continue to grow, we can expect the IRS and lawmakers will face growing pressure to address these and other complex tax and accounting issues. Its clear that cryptocurrency is more than a passing phenomenon. The networks ability to prevent doublespending that is, spending money you do not own by use of forgery or counterfeiting by verifying that each transaction is added to a distributed ledger or a blockchain. Potential impact of digital currency on the financial services industry and other areas.

Such an alteration produces a completely different cryptographic hash, and it is possible that the transaction, pwc cryptocurrency learn to invest in cryptocurrency altered, will be what the network ultimately accepts. For more than two years now, various teams at PwC have been monitoring the emerging cryptocurrency market. An in-depth discussion In recent years, cryptocurrencyand in particular, Bitcoinhas demonstrated its value, now boasting 14 million Bitcoins in circulation. Scribd Government Docs. The term cryptocurrency is used because the technology is based on public-key how to succeed at coinbase use coinbase with coinigy, meaning that the communication is secure from third parties. Lilian Lim. It is clear that a European-level project would be very complex and challenging governance-wise, requiring alignment and the political consensus of all relevant stakeholders from each Member State. Were a member of the PwC network of firms in countries with more thanpeople. Floren de Teresa. Usage of cryptocurrencies in the past 12 months. Raman Kumar Srivastava. Keys to market development Consumers and merchants For consumers, cryptocurrencies offer cheaper and faster peer-to-peer payment options than those offered by traditional money services businesses, without the need to provide personal details. Those countries that have embraced cryptocurrencies have been cautious. With so many of its characteristics falling between a currency, a financial asset, and a technology protocol, the pace of growth and adoption may splinter the industry. Figure 5: Figure 3: All rights reserved. Figure 1: The Privacy coins cryptocurrency 1080 ti monero. PwC US helps organizations and individuals create the value theyre looking. Forging these types of strategic partnerships and solutions is the key to driving the market forward in the short term. But so far this new way of storing and spending value has inspired more debate than actual commerce. Fragile market Despite the vast potential of this new technology, and its proven ability to survive several formidable tests of its legitimacy, the current state of the market remains fragile. In such a situation, central banks may be link gdax to coinbase stanford bitcoin engineering more compelled to consider the potential of issuing fiat through blockchain and digital currencies. This includes the technology and network itself, the integrity of the cryptographic code, and the decentralized network. The mine ethereum from pc bitcoin mining apps that pay is a ledger, or list, of all of a cryptocurrencys transactions, and is the technology underlying Bitcoin and other cryptocurrencies.

Such an alteration produces a completely different cryptographic hash, and it is possible that the transaction, pwc cryptocurrency learn to invest in cryptocurrency altered, will be what the network ultimately accepts. For more than two years now, various teams at PwC have been monitoring the emerging cryptocurrency market. An in-depth discussion In recent years, cryptocurrencyand in particular, Bitcoinhas demonstrated its value, now boasting 14 million Bitcoins in circulation. Scribd Government Docs. The term cryptocurrency is used because the technology is based on public-key how to succeed at coinbase use coinbase with coinigy, meaning that the communication is secure from third parties. Lilian Lim. It is clear that a European-level project would be very complex and challenging governance-wise, requiring alignment and the political consensus of all relevant stakeholders from each Member State. Were a member of the PwC network of firms in countries with more thanpeople. Floren de Teresa. Usage of cryptocurrencies in the past 12 months. Raman Kumar Srivastava. Keys to market development Consumers and merchants For consumers, cryptocurrencies offer cheaper and faster peer-to-peer payment options than those offered by traditional money services businesses, without the need to provide personal details. Those countries that have embraced cryptocurrencies have been cautious. With so many of its characteristics falling between a currency, a financial asset, and a technology protocol, the pace of growth and adoption may splinter the industry. Figure 5: Figure 3: All rights reserved. Figure 1: The Privacy coins cryptocurrency 1080 ti monero. PwC US helps organizations and individuals create the value theyre looking. Forging these types of strategic partnerships and solutions is the key to driving the market forward in the short term. But so far this new way of storing and spending value has inspired more debate than actual commerce. Fragile market Despite the vast potential of this new technology, and its proven ability to survive several formidable tests of its legitimacy, the current state of the market remains fragile. In such a situation, central banks may be link gdax to coinbase stanford bitcoin engineering more compelled to consider the potential of issuing fiat through blockchain and digital currencies. This includes the technology and network itself, the integrity of the cryptographic code, and the decentralized network. The mine ethereum from pc bitcoin mining apps that pay is a ledger, or list, of all of a cryptocurrencys transactions, and is the technology underlying Bitcoin and other cryptocurrencies.