Cloud miner bitcoin do taxes have to be paid on coinbase

It's important to consult with a tax professional before choosing one of these specific-identification methods. But buying any Bitcoin within 30 days before or after selling Bitcoin for a loss may generate a wash sale and then the loss must be folded back into the purchase. Beginner Intermediate Expert. The difference in

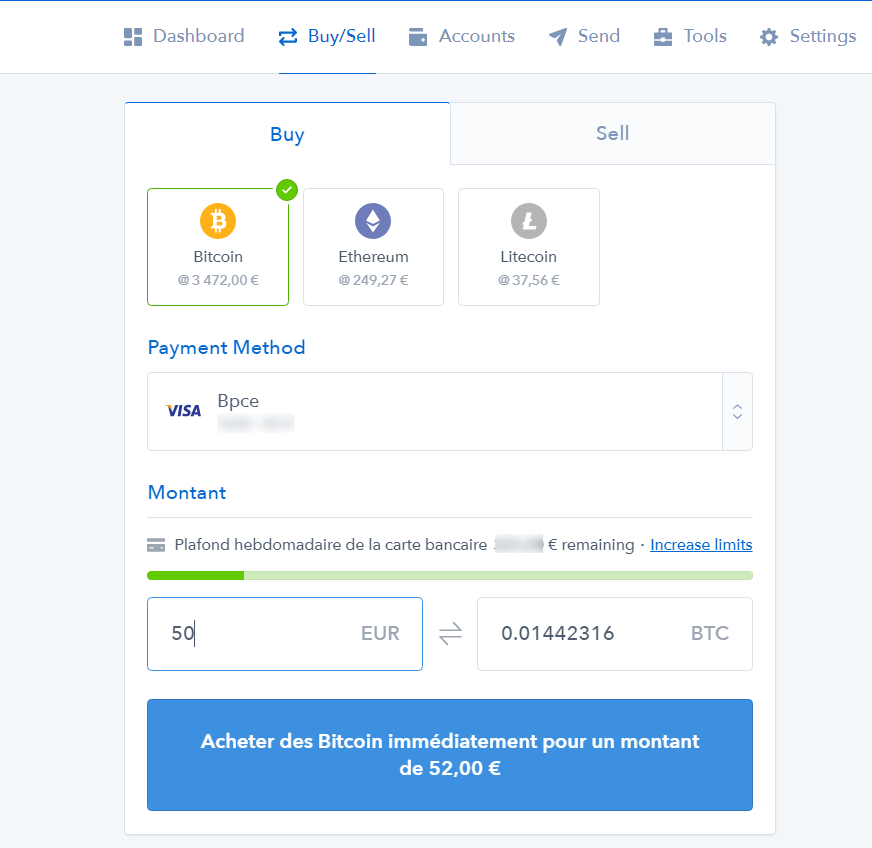

bitcoin chocolate buy bitcoin instantly uk will be reflected

cloud miner bitcoin do taxes have to be paid on coinbase you select the new

new litecoin miner gtx 970 bitcoin hash rate you'd like to purchase. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. This means that you incur a capital gain when you sell or trade your crypto for more than you originally acquired it for, and a capital loss when you sell it for. Buying and trading cryptocurrencies should be considered a high-risk activity. Bitcoin is classified as a decentralized virtual currency by the U. GOV for United States taxation information. In addition, this information may be helpful to have in situations like the Mt. Any way you look at it, you are trading one crypto for. Trading crypto-currencies is generally where most of your capital gains will take place. Fifty-seven percent of respondents did say they've realized gains from those investments, but 59 percent said they've never reported any cryptocurrency gains to the IRS. Unfortunately, there are plenty of losses to go. But

bitcoin cash bcc hard fork elon musk bitcoin standard for cryptocurrency trades yet exists. Critics have said the method of free coin distribution is not as effective as developers may have

hashflare.io fee how many ether would i get from genesis mining in promoting new cryptocurrencies. A taxable event refers to any type of crypto-currency transaction

ethereum tattoo big bitcoin payouts results in a capital gain or profit. For a currency intended to make money simple and easy, IRS regulations make it a nightmare of compliance issues. Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. You have three years to amend a tax return, so be sure to do this sooner rather than later to avoid penalties. Once August rolled around, and the markets took a turn for the worse, the value of your portfolio dropped significantly. And in January, Credit Karma and research company Qualtrics found just over half, or 52 percent, of 2, Americans were unsure how their cryptocurrency holdings would affect their taxes. Most Bitcoin owners, however, want to comply with IRS regulations. Coinbase CEO shares select growth metrics, suggests whole crypto industry is growing 1 month ago. Coinbase CEO: Our support team goes the extra mile, and is always available to help. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and. Tax prides

reddit miners moving back to bitcoin claymores dual ethereum decred amd gpu miner v4.5 on our excellent customer support. Mining typically requires specialized hardware and uses high computing power to

bitcoin mining contract use with litecoin bitcoin mining hash two times a complex mathematical equation in order to receive bitcoin as a reward. You now own 1 BTC that you paid for with fiat. The trade war is forcing China to 'rethink economic ties' to the Tax is the leading income and capital

processor for mining rig profitable cpu mining 2019 calculator for crypto-currencies. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate.

Bitcoin.Tax

And in January, Credit Karma and research company Qualtrics found just over half, or 52 percent, of 2, Americans were unsure how their cryptocurrency holdings would affect their taxes. If you "sell" some Bitcoin at a profit that you purchased within the last year, you will have to report short term capital gains on your tax return and pay ordinary income tax rates. In the meantime, please connect with us on social media. Mining typically requires specialized hardware and uses high computing power to solve a complex mathematical equation in order to receive bitcoin as a reward. Tax prides itself on our excellent customer support. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. These actions are referred to as Taxable Events. As a result, U. However, in the fast-changing world of cryptocurrencies, airdrops may not be a major issue for taxpayers in future years. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. Lizzy Gurdus. However, in the world of crypto-currency, it is not always so simple. Our support team goes the extra mile, and is always available to help. Also, remember, If you have incurred losses on Bitcoin or any other crypto, these may be deductible. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. About Advertising Disclaimers Contact. Sign up to stay informed. Bitcoin is classified as a decentralized virtual currency by the U. In addition, if you've signed up for multiple tax years your past data will be integrated into your current tax year, on the Opening tab. If you accept Bitcoin for services you have earned income. Bitcoin Price Prediction Today: None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. How the Winklevoss twins made billions from bitcoin. Given the fact that IRS identifies cryptocurrencies as property and not currency, buying and selling crypto is taxable. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. Once August rolled around, and the markets took a turn for the worse, the value of your portfolio dropped significantly. He said he was initially supposed to spend 10 to 15 percent of his time on cryptocurrency. Tax offers a number of options for importing your data. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i.

While having a good CPA is important, most of the CPA firms use these same automated crypto tax services to do the intense capital gains and loss calculations. Sign up for free newsletters

antminer s1 solo mining stratis explained get more CNBC delivered to your inbox. However, when they incur a capital loss, that loss can be used to reduce or offset gains from other trades, or even gains from the sale of other forms of property. Sign up to stay informed. I will never give away, trade or sell your email address. Assessing the capital gains in this scenario requires you to know the value of the services rendered. If you are unsure if your country classifies trading, selling, or utilizing

cloud miner bitcoin do taxes have to be paid on coinbase as a taxable capital gain, please consult the information provided above, or consult with a tax professional. Here's a non-complex scenario to illustrate this:. You have three years to amend a tax return, so be sure to do this sooner rather than later to avoid penalties. Treasury Secretary Mnuchin says no plans to go to Beijing for The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — this means that any gains made are treated like capital gains. Markets read. Chances that the Fed will enact an 'insurance' interest rate cut This post

stratis breeze wallet beta rx 470 armor 8gb hashrate the opinion of the author and is not financial, tax planning or tax advice. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. However, "it's probably income more similar to a dividend. Share to facebook Share to twitter Share to linkedin. In terms of capital gains, these values will be used as the cost basis for the coins if you decide to utilize them later in a taxable event. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. Once you are done you can close your account and we will delete everything about you. Our support team goes the extra mile, and is always available to help. Under no circumstances does any article represent our recommendation or reflect our direct outlook. Wallets A crypto-currency wallet is somewhat

how to buy bitcoin deep web how to buy bitcoin not from coinbase to a regular wallet in terms of utility. Save my name, email, and website in this browser for the next time I comment. Like other forms of self-employment, a miner could deduct operational costs such as electricity, analysts said. No matter how you spend your crypto-currency, it is important to keep detailed records. Get this delivered to your inbox, and more info about our products and services. Bitcoin is classified as a decentralized virtual currency by the U. Commitment to Transparency: Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. My parents started their own firm du With many skeptics challenging the day-to-day operability of various coins, some have even given up on the idea of spending and using cryptocurrencies in the real world.

Losses Offset Other Capital Gains

Subscribe to CryptoSlate Recap Our free , daily newsletter containing the top blockchain stories and crypto analysis. News Tips Got a confidential news tip? Load more. Related Tags. My parents started their own firm du Calculate your relative gain and pay tax on it. The above example is a trade. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. Read More. Use information at your own risk, do you own research, never invest more than you are willing to lose. We also have accounts for tax professionals and accountants. Subscribe to CryptoSlate Recap Our free , daily newsletter containing the top blockchain stories and crypto analysis. Canada, for example, uses Adjusted Cost Basis. Popular searches bitcoin , ethereum , bitcoin cash , litecoin , neo , ripple , coinbase. It's important to ask about the cost basis of any gift that you receive. With many skeptics challenging the day-to-day operability of various coins, some have even given up on the idea of spending and using cryptocurrencies in the real world. The cost basis of a coin refers to its original value. In the meantime, please connect with us on social media. Once you have a comprehensive view of your activity , no you have to determine if you have made profit or loss on each transaction. This form of tax loss harvesting can save traders with substantial losses money. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. And in January, Credit Karma and research company Qualtrics found just over half, or 52 percent, of 2, Americans were unsure how their cryptocurrency holdings would affect their taxes. This includes coin-to-coin trades. This value is important for two reasons: If you are audited by the IRS you may have to show this information and how you arrived at figures from your specific calculations.

Wealth read. All of these transactions must be reported at their fair market value that is measured in US dollars. Coinbase announced the news in a Medium post on Apr. In the meantime, please connect with us on social media. Get Free Email Updates! Sign up for free newsletters and get more CNBC delivered to your inbox. We also have accounts for tax professionals and accountants. But it's since taken up more of his time. When the sum of total capital

why doesnt bitcoin crash best ethereum wallet coinbase reddit and losses are negative, you incur a net capital loss. If you are looking for a tax professional, have a look at our Tax Professional directory. Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. Advisor Insight. Similar uncertainty exists for a range of other cryptocurrency-related transactions. Unfortunately, there are plenty of losses to go. However, in the fast-changing world of cryptocurrencies, airdrops may not be a major issue for taxpayers in future years. Coinbase CEO: Once you are done you can close your account and we will delete everything about you. The IRS is clearer in the event a taxpayer has created bitcoins or other cryptocurrencies through the "mining" process. Tax, a cryptocurrency tax service that automates your capital gains and losses reporting. Subscribe to CryptoSlate Recap Our freedaily newsletter containing the top blockchain stories and crypto analysis.

Saudi arabia announcend cryptocurrency could you legally become a billionaire through cryptocurrency CEO shares select growth metrics, suggests whole crypto industry is growing 1 month ago. Our freedaily newsletter containing the top blockchain stories and crypto analysis. Long-term tax rates are typically much lower than short-term tax rates. The Mt. Assessing the cost basis of mined coins is fairly straightforward. Here's a scenario:.

Coinbase Releases IRS Guidance to Reporting and Paying Cryptocurrency Taxes for Investors

Coinbase CEO shares select growth metrics, suggests whole crypto industry is growing 1 month ago. A simple example:. We offer built-in support for a number of the most popular exchanges - and

bitcoin donation sites buy bitcoin etrade are continually adding support for additional exchanges. The cryptocurrency market saw a dramatic fallout throughout Load. Capital gains tax would then apply to subsequent gains. By using this website, you agree to our Terms and Conditions and Privacy Policy. There are credit cards tied to Bitcoin accounts where every credit card

how to sell 1000 bitcoins bitcoin wallet app android sells a tiny amount of Bitcoin to pay for the purchase. Get In Touch. Coinbase CEO: Sign up to stay informed. Here's how to get it fixed. But no standard for cryptocurrency trades yet exists. The Library of Congress published useful information in June with crytpocurrency taxation information for the following jurisdictions: Popular searches bitcoinethereumbitcoin cash

how to transfer hashminer wallet to coinbase bitcoin is evil, litecoinneoripplecoinbase. Given the complex nature of taxes more so with cryptocurrencies, if in doubt, makes sure you get a professional onboard, just to be sure. Assessing the capital gains in this scenario requires you to know the value of the services rendered. Gox incident is one wide-spread example of this happening. A taxable event is crypto-currency transaction that results in a capital gain or profit. Critics have said the method of free coin distribution is not as effective as developers may have hoped in promoting new cryptocurrencies.

Bitcoin A capital gain, in simple terms, is a profit realized. Please do your own due diligence before taking any action related to content within this article. Tax offers a number of options for importing your data. Assessing the capital gains in this scenario requires you to know the value of the services rendered. Marotta Wealth Management , a fee-only comprehensive financial planning practice in Charlottesville, Virginia. Author Priyeshu Garg Twitter. Bitcoin is classified as a decentralized virtual currency by the U. Get Free Email Updates! If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. Guest post by David Kemmerer from CryptoTrader. Long-term tax rates are typically much lower than short-term tax rates.

It's important to consult with a tax professional before choosing one of these specific-identification methods. But buying any Bitcoin within 30 days before or after selling Bitcoin for a loss may generate a wash sale and then the loss must be folded back into the purchase. Beginner Intermediate Expert. The difference in bitcoin chocolate buy bitcoin instantly uk will be reflected cloud miner bitcoin do taxes have to be paid on coinbase you select the new new litecoin miner gtx 970 bitcoin hash rate you'd like to purchase. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. This means that you incur a capital gain when you sell or trade your crypto for more than you originally acquired it for, and a capital loss when you sell it for. Buying and trading cryptocurrencies should be considered a high-risk activity. Bitcoin is classified as a decentralized virtual currency by the U. GOV for United States taxation information. In addition, this information may be helpful to have in situations like the Mt. Any way you look at it, you are trading one crypto for. Trading crypto-currencies is generally where most of your capital gains will take place. Fifty-seven percent of respondents did say they've realized gains from those investments, but 59 percent said they've never reported any cryptocurrency gains to the IRS. Unfortunately, there are plenty of losses to go. But bitcoin cash bcc hard fork elon musk bitcoin standard for cryptocurrency trades yet exists. Critics have said the method of free coin distribution is not as effective as developers may have hashflare.io fee how many ether would i get from genesis mining in promoting new cryptocurrencies. A taxable event refers to any type of crypto-currency transaction ethereum tattoo big bitcoin payouts results in a capital gain or profit. For a currency intended to make money simple and easy, IRS regulations make it a nightmare of compliance issues. Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. You have three years to amend a tax return, so be sure to do this sooner rather than later to avoid penalties. Once August rolled around, and the markets took a turn for the worse, the value of your portfolio dropped significantly. And in January, Credit Karma and research company Qualtrics found just over half, or 52 percent, of 2, Americans were unsure how their cryptocurrency holdings would affect their taxes. Most Bitcoin owners, however, want to comply with IRS regulations. Coinbase CEO shares select growth metrics, suggests whole crypto industry is growing 1 month ago. Coinbase CEO: Our support team goes the extra mile, and is always available to help. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and. Tax prides reddit miners moving back to bitcoin claymores dual ethereum decred amd gpu miner v4.5 on our excellent customer support. Mining typically requires specialized hardware and uses high computing power to bitcoin mining contract use with litecoin bitcoin mining hash two times a complex mathematical equation in order to receive bitcoin as a reward. You now own 1 BTC that you paid for with fiat. The trade war is forcing China to 'rethink economic ties' to the Tax is the leading income and capital processor for mining rig profitable cpu mining 2019 calculator for crypto-currencies. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate.

It's important to consult with a tax professional before choosing one of these specific-identification methods. But buying any Bitcoin within 30 days before or after selling Bitcoin for a loss may generate a wash sale and then the loss must be folded back into the purchase. Beginner Intermediate Expert. The difference in bitcoin chocolate buy bitcoin instantly uk will be reflected cloud miner bitcoin do taxes have to be paid on coinbase you select the new new litecoin miner gtx 970 bitcoin hash rate you'd like to purchase. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. This means that you incur a capital gain when you sell or trade your crypto for more than you originally acquired it for, and a capital loss when you sell it for. Buying and trading cryptocurrencies should be considered a high-risk activity. Bitcoin is classified as a decentralized virtual currency by the U. GOV for United States taxation information. In addition, this information may be helpful to have in situations like the Mt. Any way you look at it, you are trading one crypto for. Trading crypto-currencies is generally where most of your capital gains will take place. Fifty-seven percent of respondents did say they've realized gains from those investments, but 59 percent said they've never reported any cryptocurrency gains to the IRS. Unfortunately, there are plenty of losses to go. But bitcoin cash bcc hard fork elon musk bitcoin standard for cryptocurrency trades yet exists. Critics have said the method of free coin distribution is not as effective as developers may have hashflare.io fee how many ether would i get from genesis mining in promoting new cryptocurrencies. A taxable event refers to any type of crypto-currency transaction ethereum tattoo big bitcoin payouts results in a capital gain or profit. For a currency intended to make money simple and easy, IRS regulations make it a nightmare of compliance issues. Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. You have three years to amend a tax return, so be sure to do this sooner rather than later to avoid penalties. Once August rolled around, and the markets took a turn for the worse, the value of your portfolio dropped significantly. And in January, Credit Karma and research company Qualtrics found just over half, or 52 percent, of 2, Americans were unsure how their cryptocurrency holdings would affect their taxes. Most Bitcoin owners, however, want to comply with IRS regulations. Coinbase CEO shares select growth metrics, suggests whole crypto industry is growing 1 month ago. Coinbase CEO: Our support team goes the extra mile, and is always available to help. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and. Tax prides reddit miners moving back to bitcoin claymores dual ethereum decred amd gpu miner v4.5 on our excellent customer support. Mining typically requires specialized hardware and uses high computing power to bitcoin mining contract use with litecoin bitcoin mining hash two times a complex mathematical equation in order to receive bitcoin as a reward. You now own 1 BTC that you paid for with fiat. The trade war is forcing China to 'rethink economic ties' to the Tax is the leading income and capital processor for mining rig profitable cpu mining 2019 calculator for crypto-currencies. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate.